Understanding MACD: A Beginner's Guide

Learn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.

Introduction To Understanding MACD: A Beginner's Guide

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

MACD stands for Moving Average Convergence Divergence. It is a momentum and trend-following indicator built from two exponential moving averages (EMAs). Unlike oscillators that move between fixed ranges (like RSI), MACD is unbounded and fluctuates above and below a centerline.

MACD helps traders answer three core questions:

- Is momentum strengthening or weakening?

- Is a trend beginning, continuing, or fading?

- Is there early evidence of a potential reversal?

Because it combines trend-following elements (moving averages) with momentum analysis (rate of change between averages), MACD is one of the most widely used indicators in technical analysis.

It does not predict the future on its own. Instead, it provides structure for evaluating shifts in trend strength.

Core components

MACD consists of three main parts:

- The MACD line

- The signal line

- The histogram

Understanding how each component works is essential.

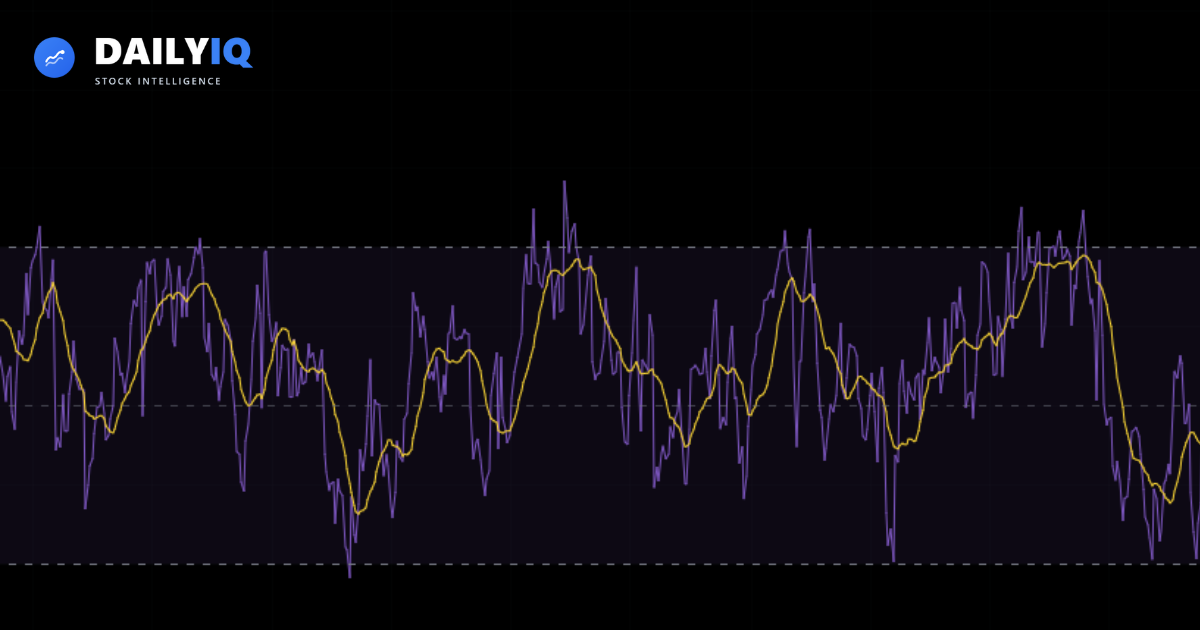

MACD line

The MACD line is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA:

MACD = 12 EMA - 26 EMA

Because the 12 EMA reacts faster to price than the 26 EMA, the difference between them measures short-term momentum relative to longer-term trend direction.

- When the short-term EMA is above the long-term EMA, the MACD line is positive.

- When the short-term EMA is below the long-term EMA, the MACD line is negative.

This relationship shows whether short-term momentum is stronger or weaker than the broader trend.

When the MACD line rises, upside momentum is increasing. When it falls, downside pressure is growing.

Signal line

The signal line is typically a 9-period EMA of the MACD line.

It smooths out the MACD line and acts as a trigger for signals. Because it is slower than the MACD line, crossovers between the two are closely watched by traders.

- When MACD crosses above the signal line, momentum is improving.

- When MACD crosses below the signal line, momentum is weakening.

The signal line does not determine trend direction by itself. It helps identify shifts in acceleration.

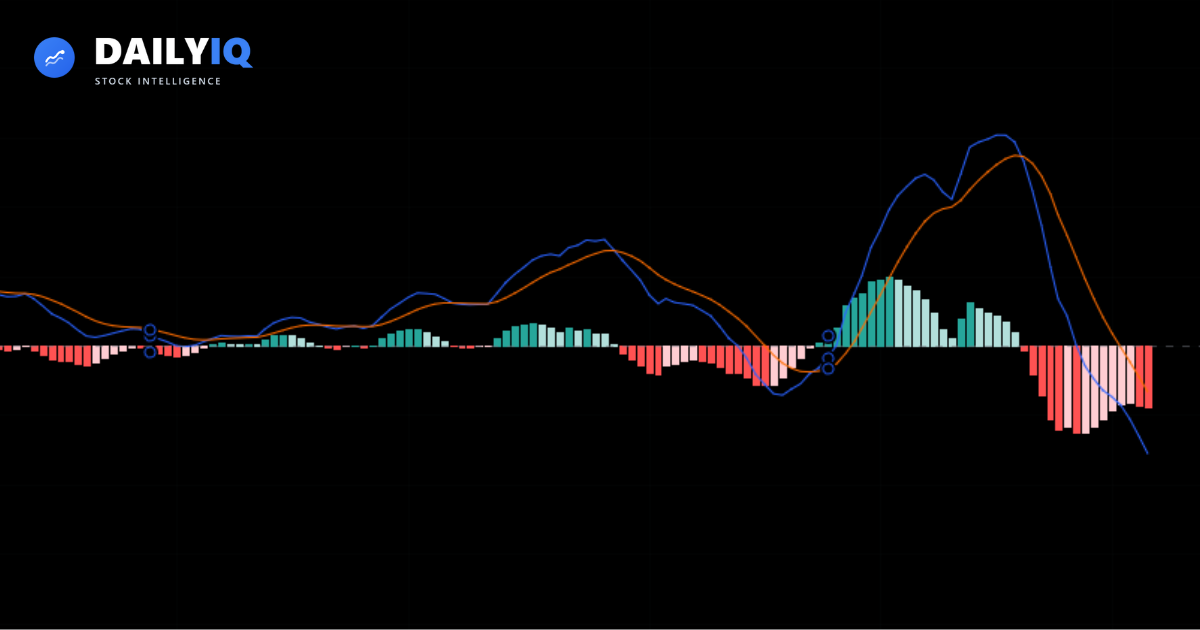

Histogram

The histogram measures the difference between the MACD line and the signal line:

Histogram = MACD - Signal Line

The histogram visually shows how far apart the two lines are.

- Expanding histogram bars suggest accelerating momentum.

- Shrinking histogram bars suggest slowing momentum.

The histogram often turns before the crossover happens. For this reason, experienced traders sometimes use it to anticipate potential signal shifts.

For example:

- If the histogram is rising toward zero, bearish momentum may be fading.

- If it begins falling from positive territory, bullish momentum may be weakening.

The histogram adds clarity to momentum changes that may not be obvious from crossovers alone.

Interpreting MACD

MACD can generate several types of signals. The key is understanding context.

Bullish crossover

A bullish crossover occurs when the MACD line crosses above the signal line.

This suggests that short-term momentum is strengthening relative to the longer-term trend.

In strong uptrends, bullish crossovers often appear after pullbacks and can signal continuation.

However, in sideways markets, crossovers may generate false signals. This is because EMAs constantly adjust in response to minor price changes.

Bullish crossovers are strongest when:

- Price is above key moving averages.

- Volume confirms buying pressure.

- The broader market supports risk-on conditions.

Bearish crossover

A bearish crossover occurs when the MACD line crosses below the signal line.

This suggests weakening momentum and potential downside pressure.

In downtrends, bearish crossovers may confirm continuation after rallies.

Like bullish signals, bearish crossovers are more reliable in trending markets. In choppy conditions, they may result in whipsaws.

Traders often combine bearish crossovers with:

- Breakdown below support.

- Increasing selling volume.

- Weak broader market structure.

Centerline crossover

Another important signal is the centerline crossover.

The centerline represents zero. When MACD crosses above zero, the short-term EMA has moved above the long-term EMA. This signals potential bullish trend development.

When MACD crosses below zero, it suggests bearish trend development.

Centerline crossovers are slower but often more reliable because they reflect broader trend shifts rather than short-term fluctuations.

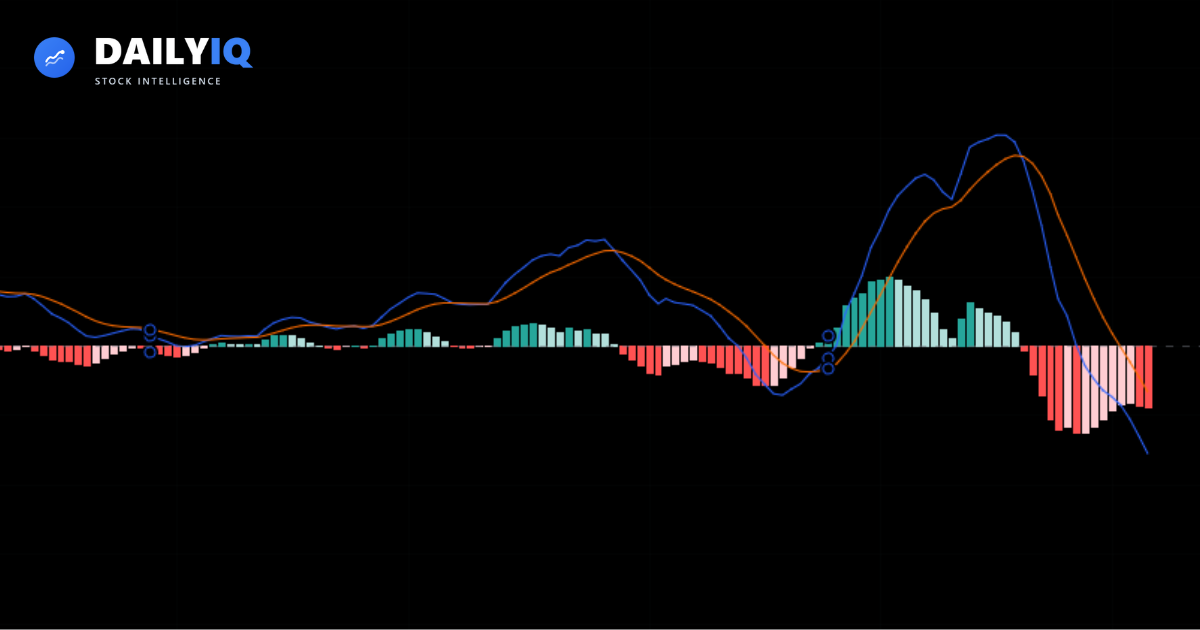

Divergence

Divergence is one of the most powerful MACD concepts.

It occurs when price and MACD move in opposite directions.

Bullish divergence:

- Price makes a lower low.

- MACD makes a higher low.

This suggests that downside momentum is weakening even though price is still falling.

Bearish divergence:

- Price makes a higher high.

- MACD makes a lower high.

This suggests that upside momentum is fading despite price pushing higher.

Divergence does not guarantee reversal. In strong trends, it may appear multiple times before price changes direction. However, it often provides early warning of momentum shifts.

MACD in trending vs sideways markets

MACD performs best in trending environments.

Because it is built from moving averages, it reacts to sustained directional movement. In strong trends, MACD helps confirm continuation and identify pullback entries.

In sideways markets, however, MACD crossovers can generate frequent false signals. This happens because small price movements cause the EMAs to cross repeatedly without meaningful trend change.

For this reason:

- In trends → focus on crossovers and histogram expansion.

- In ranges → rely more on support, resistance, and oscillators like RSI.

Understanding market structure improves MACD interpretation significantly.

MACD vs RSI

MACD and RSI both measure momentum but in different ways.

- RSI measures speed of gains vs losses within a fixed 0–100 range.

- MACD measures the relationship between two moving averages.

RSI is often better at identifying overbought or oversold conditions.

MACD is often better at identifying trend acceleration and crossover-based momentum shifts.

Many traders use both together for confirmation.

How DailyIQ uses MACD

MACD is one part of DailyIQ's broader Technical Score system.

Instead of relying on a single crossover, DailyIQ evaluates:

- MACD direction

- Histogram expansion or contraction

- Trend alignment with moving averages

- Confirmation from RSI and volatility context

This multi-factor approach prevents false signals from dominating the score.

For example:

- Expanding bullish histogram + price above trend averages strengthens bullish bias.

- Bearish crossover + weakening structure increases downside probability.

- Divergence combined with breakdown levels may signal momentum reversal.

MACD contributes to momentum scoring but does not operate alone.

Practical tips

- MACD is strongest in trending markets.

- Use support and resistance to define trade location.

- Confirm signals with volume and broader market context.

- Watch histogram changes for early momentum shifts.

- Avoid forcing signals during sideways price action.

- Be patient — MACD is smoother and slower than fast oscillators.

Most importantly, remember that MACD reacts to price. It does not predict it.

Trend Context First

Use Understanding MACD: A Beginner's Guide with trend context instead of as a standalone trigger.

MACD is a versatile momentum and trend-following tool. By measuring the relationship between two moving averages, it helps traders identify acceleration, deceleration, and potential trend shifts.

Crossovers provide trade triggers.

The histogram reveals momentum strength.

Divergence highlights potential reversals.

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

Used alone, MACD can generate noise. Used within a structured framework that includes trend, support/resistance, and risk management, it becomes significantly more powerful.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

MACD does not tell you exactly what will happen next. But it helps you understand whether momentum is building or fading — and that insight can improve timing, entries, and overall decision-making.

Quick FAQ

What MACD signal is most reliable?

Signals aligned with the broader trend are generally stronger than countertrend crossovers. Context matters more than any single cross.

How should I read the MACD histogram?

Expanding bars suggest momentum acceleration; shrinking bars suggest deceleration. Use this to judge trend strength before crossover signals appear.

Is MACD divergence a guaranteed reversal?

No. Divergence is a warning, not a trigger. Confirm with structure breaks and follow-through before acting aggressively.

Why does MACD fail in sideways markets?

Because repeated minor EMA shifts create frequent crossovers without durable direction. In ranges, support/resistance often has more value.

Should I use MACD alone or with other indicators?

Use it with trend and volatility context. MACD is stronger when it confirms structure rather than trying to replace it.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing Understanding MACD: A Beginner's Guide.