What Is RSI and How to Read It

Learn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.

Introduction To What Is RSI and How to Read It

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

The Relative Strength Index (RSI) is one of the most widely used momentum indicators in technical analysis. It helps traders understand how strong recent price movements are and whether that strength may be stretched too far in one direction.

RSI is displayed as an oscillator, meaning it moves within a fixed range between 0 and 100. Instead of following price directly, it measures the speed and magnitude of recent gains versus recent losses. By doing so, it gives traders insight into momentum conditions that are not always obvious from price alone.

When price rises aggressively, RSI increases. When price falls sharply, RSI decreases. The indicator helps answer a simple but important question:

Is momentum accelerating, weakening, or becoming overextended?

RSI does not predict the future by itself. Instead, it provides context — helping traders judge whether a move is strong, weakening, or potentially stretched.

How RSI works

RSI is most commonly calculated using 14 periods. On a daily chart, that means 14 trading days. On a 1-hour chart, it means 14 hours.

The standard formula is:

RSI = 100 - (100 / (1 + RS))

Where:

RS(Relative Strength) equals the average gain divided by the average loss over the chosen lookback period.

The calculation works in two main steps:

- Measure the average gains and average losses over the last 14 periods.

- Compare those values to determine the strength of buying pressure relative to selling pressure.

If gains are larger than losses, RSI rises.

If losses are larger than gains, RSI falls.

The output always stays between 0 and 100:

- Near 0 → very strong downside momentum

- Near 100 → very strong upside momentum

Because RSI is smoothed, it does not jump instantly. It responds gradually as new price data is added.

Reading RSI signals

RSI is typically interpreted using three main zones: overbought, oversold, and neutral.

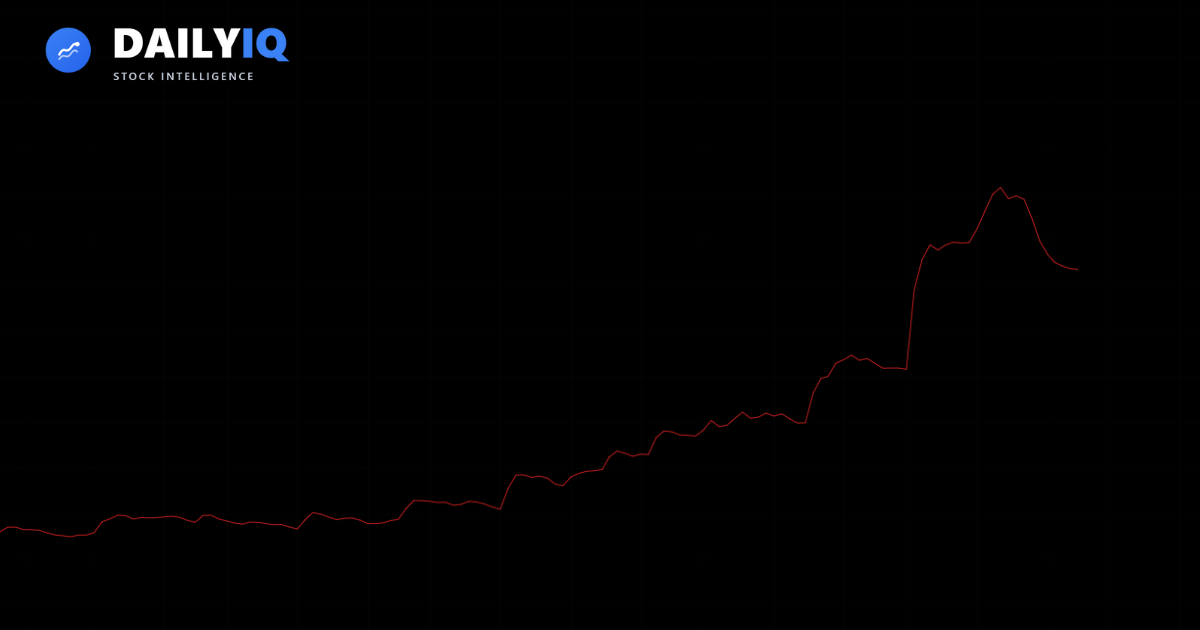

Overbought zone (above 70)

An RSI reading above 70 is traditionally considered overbought. This suggests that recent buying pressure has been strong and may be becoming stretched.

However, “overbought” does not mean price must fall immediately.

In strong uptrends, RSI can remain above 70 for extended periods while price continues climbing. This is known as “riding momentum.” Selling simply because RSI is above 70 can lead to exiting strong trends too early.

Instead, traders often treat high RSI readings as:

- A caution signal

- A possible sign of short-term exhaustion

- A reason to tighten risk management

Context matters. In a powerful bullish trend, high RSI may confirm strength rather than warn of reversal.

Oversold zone (below 30)

An RSI reading below 30 is traditionally considered oversold. This suggests strong recent selling pressure.

In range-bound markets, oversold conditions can lead to rebounds. Traders sometimes look for price stabilization and confirmation signals when RSI drops below 30.

However, just like with overbought conditions, oversold does not automatically mean price will bounce.

In strong downtrends, RSI can remain below 30 for extended periods while price keeps falling. Buying too early in these conditions can be risky.

Instead, oversold RSI often signals:

- Heavy bearish momentum

- Potential exhaustion

- A need for confirmation before entering trades

Neutral zone (30 to 70)

The area between 30 and 70 is often overlooked, but it provides important trend information.

In healthy uptrends:

- RSI often stays between 40 and 80.

- Pullbacks may stop near 40–50 before momentum resumes upward.

In strong downtrends:

- RSI may remain between 20 and 60.

- Rallies may fail near 50–60 before downside momentum returns.

The middle range can help traders identify whether momentum is strengthening or weakening within an existing trend.

For example:

- Rising RSI from 45 to 60 suggests strengthening bullish momentum.

- Falling RSI from 55 to 40 suggests increasing bearish pressure.

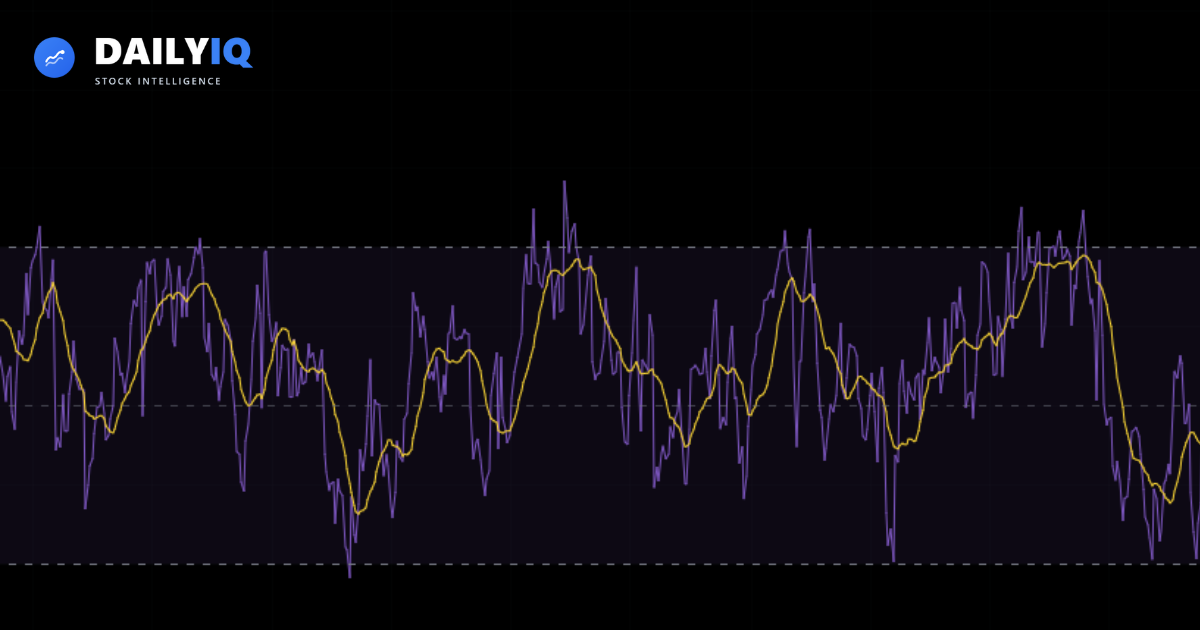

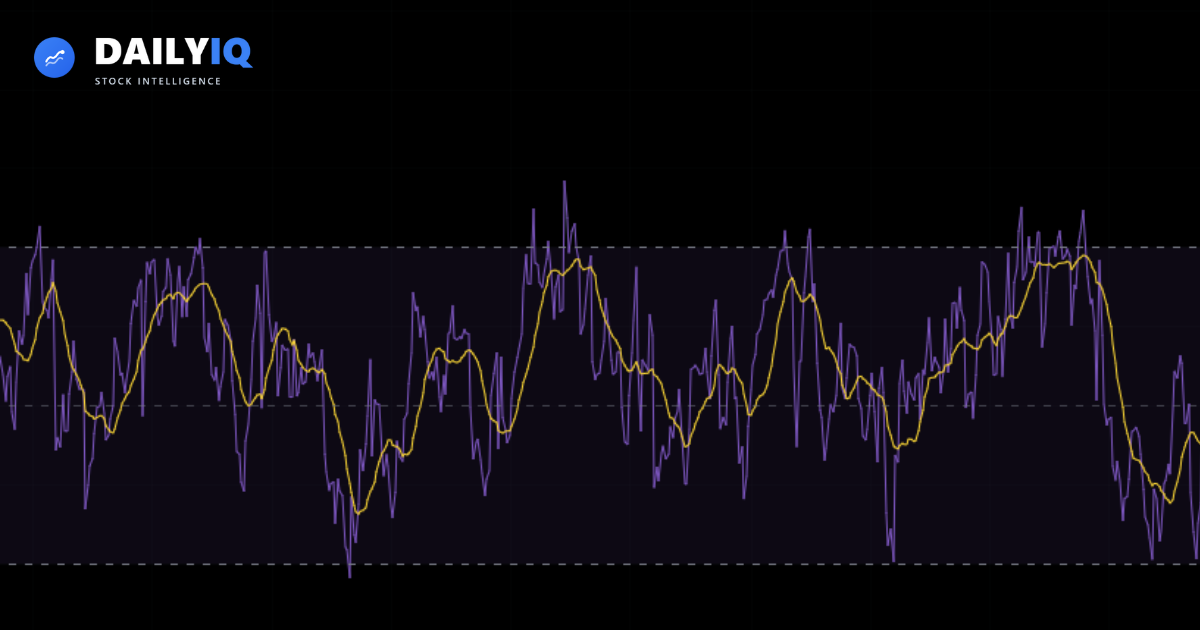

RSI divergence

One of the most powerful RSI concepts is divergence.

Divergence occurs when price and RSI move in opposite directions.

Bullish divergence

- Price makes a lower low.

- RSI makes a higher low.

This suggests that downside momentum is weakening even though price is still falling. It can signal a potential reversal or bounce.

Bearish divergence

- Price makes a higher high.

- RSI makes a lower high.

This suggests that upside momentum is weakening even though price continues rising.

Divergence is not a guaranteed reversal signal. In strong trends, divergence can appear multiple times before price actually turns. However, it often provides early warning that momentum is shifting.

RSI in trending vs ranging markets

RSI behaves differently depending on market structure.

In range-bound markets, RSI tends to move predictably between 30 and 70. Overbought and oversold signals are more reliable in these conditions.

In strong trending markets, RSI signals can produce false reversals. Instead of focusing on 30 and 70, traders often adjust expectations:

- In uptrends, RSI pullbacks toward 40–50 can act as support.

- In downtrends, RSI rallies toward 50–60 can act as resistance.

Understanding market structure helps avoid misinterpreting RSI readings.

RSI vs other indicators

RSI measures momentum. It does not measure trend direction directly.

For that reason, many traders combine RSI with:

- Moving averages (to identify trend)

- Support and resistance levels

- Volume analysis

- MACD (to compare momentum perspectives)

RSI works best as part of a system rather than a standalone signal.

How DailyIQ uses RSI

DailyIQ includes RSI as one component inside its broader Technical Score framework.

Rather than treating RSI above 70 or below 30 as automatic signals, DailyIQ evaluates RSI alongside:

- Trend structure

- Volatility conditions

- Volume confirmation

- Other momentum indicators

This prevents any single indicator from dominating the analysis.

For example:

- High RSI with strong trend alignment may confirm strength.

- High RSI with weakening structure may signal caution.

- Divergence combined with breakdown levels may increase reversal probability.

RSI becomes more powerful when viewed as part of a weighted framework.

Best practices

- Do not trade RSI in isolation.

- Always identify the primary trend first.

- Use RSI for timing within structure, not for predicting tops and bottoms.

- Look for divergence at key support or resistance levels.

- Adjust RSI expectations based on trending vs ranging conditions.

- Combine RSI with risk management rules.

Most importantly, remember that RSI measures momentum — not certainty.

Trend Context First

Use What Is RSI and How to Read It with trend context instead of as a standalone trigger.

The Relative Strength Index is a practical and accessible momentum tool. By comparing recent gains and losses, it helps traders understand whether buying or selling pressure is accelerating or weakening.

Overbought and oversold levels provide useful context, but they must be interpreted within market structure. Divergences can highlight potential reversals, while RSI behavior within trends can confirm strength or weakness.

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

When used alongside trend analysis, volume, and risk management, RSI can improve entries, exits, and overall decision-making.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

Momentum does not predict the future — but it often tells you when conditions are stretched or shifting. Used properly, RSI helps you see that shift earlier and trade with better awareness.

Quick FAQ

Does RSI above 70 always mean sell?

No. In strong uptrends, RSI can stay elevated while price continues higher. Treat high RSI as context, then look for weakening structure before fading momentum.

How should I use RSI divergence in practice?

Use divergence as an alert to tighten risk, not an automatic reversal trade. Confirmation should come from price structure and follow-through.

Should RSI levels change in trending markets?

Yes. Uptrends often hold higher RSI ranges (for example, pullbacks near 40-50), while downtrends often cap lower (for example, rallies near 50-60).

Which timeframe gives the best RSI signals?

Signals are generally cleaner on higher timeframes. Lower timeframes react faster but produce more noise and more false swings.

What is the most common RSI mistake?

Treating overbought or oversold as standalone entries without trend context, location, and risk planning.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing What Is RSI and How to Read It.

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read

What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read

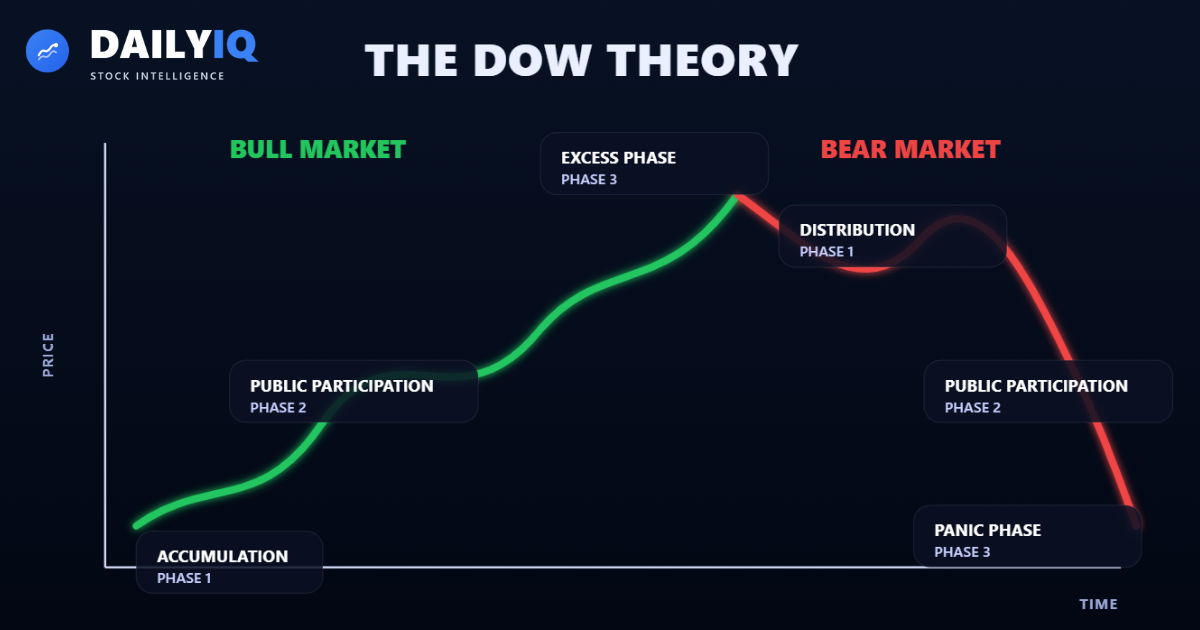

What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read

Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read