DailyIQ Learning Center

Master technical analysis, understand market indicators, and learn how to use DailyIQ to improve your trading decisions.

Featured

Check out our featured article and strengthen your understanding of market structure

Trend Lines in Technical Analysis: The Complete Institutional Guide

Master trend lines, accelerating and decelerating structures, channels, log scale, Pitchfork, Gann fans, and professional breakout confirmation.

All Articles

Explore our featured analysis and strengthen your understanding of market structure

Trend Lines in Technical Analysis: The Complete Institutional Guide

Master trend lines, accelerating and decelerating structures, channels, log scale, Pitchfork, Gann fans, and professional breakout confirmation.

Feb 9, 2026

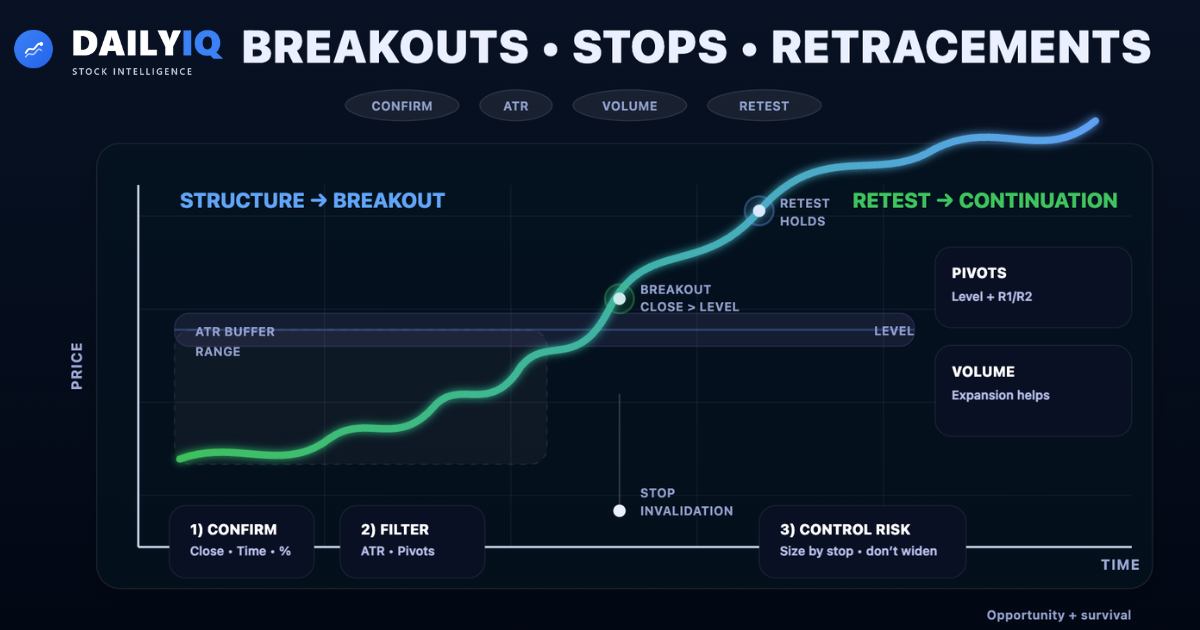

Breakouts, Stops & Retracements: The Institutional Trading Framework

Master breakout confirmation, volume analysis, volatility filters, ATR methods, pivot techniques, anticipation signals, and professional stop-loss management.

Feb 11, 2026

The Basic Principle of Technical Analysis — The Trend

Understand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.

Feb 4, 2026

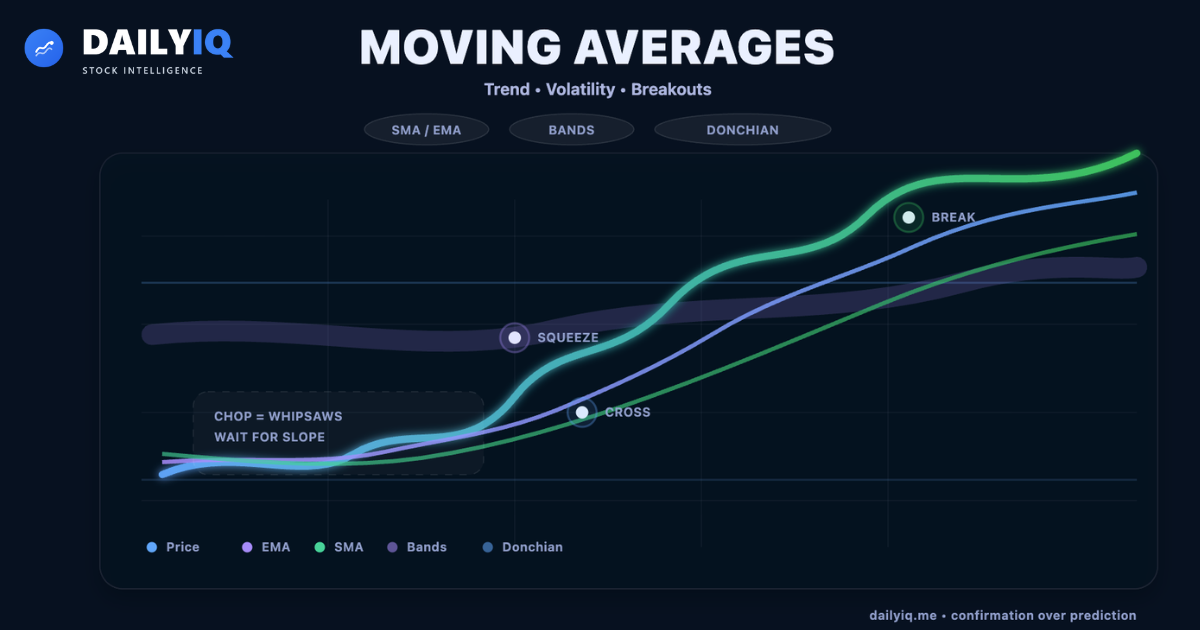

Moving Averages: Complete Guide to Trend Identification, Bands, Envelopes, and Breakout Channels

Master moving averages from core smoothing mechanics to advanced volatility tools. Learn SMA vs EMA, crossover signals, whipsaws, envelopes, Bollinger/Keltner/STARC bands, Donchian breakouts, and how institutions confirm trends and filter false signals.

Feb 14, 2026

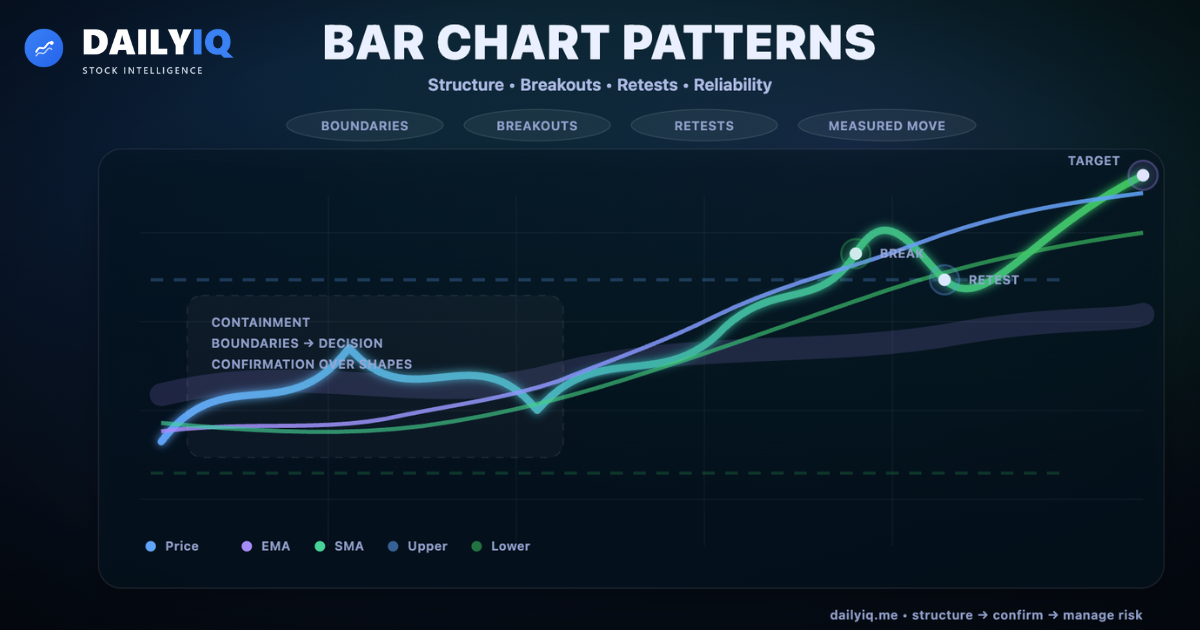

Bar Chart Patterns: Complete Guide to Structure, Breakouts, Retests, and Reliability

Master bar chart patterns from boundary definition to breakout confirmation. Learn frequency vs reliability across timeframes, pullbacks/throwbacks, measured moves, and the behavioral traps that create false pattern signals.

Feb 14, 2026

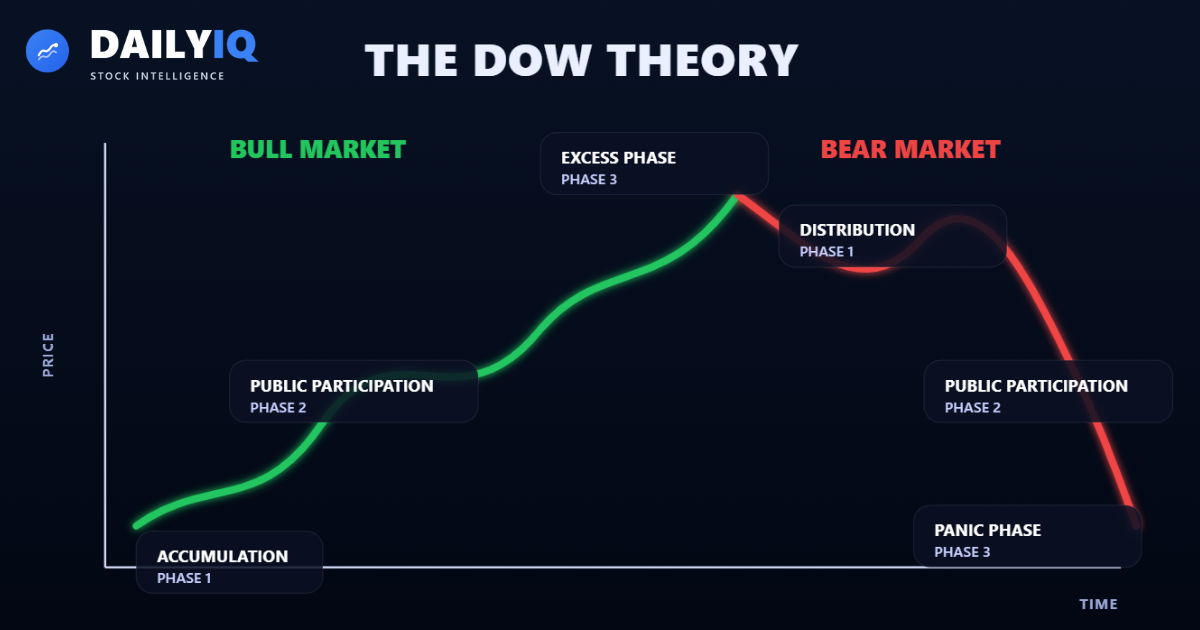

Dow Theory History, Theorems, Trends, Confirmation, Volume & Criticisms

A comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.

Feb 4, 2026

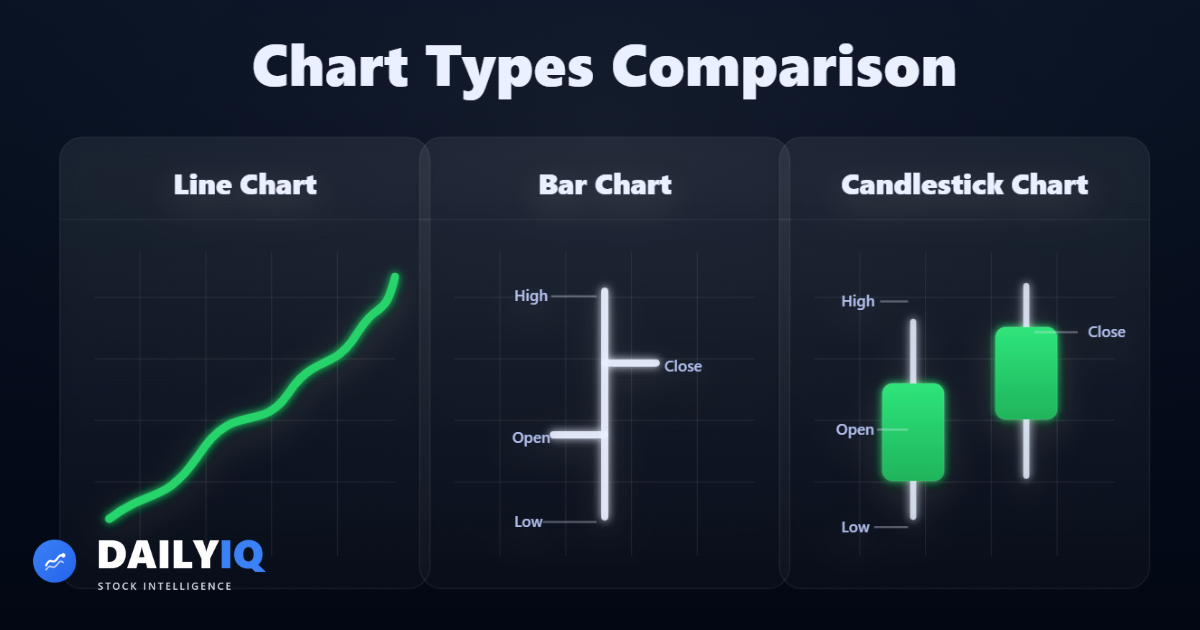

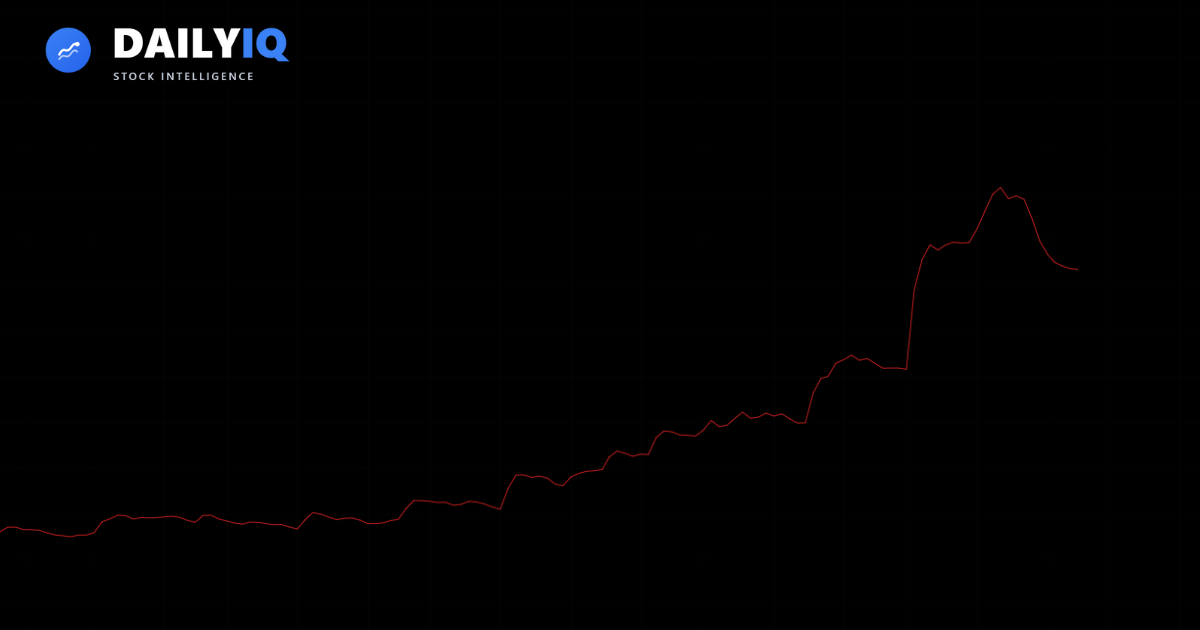

Introduction to Charts — Line, Bar & Candlestick Charts Explained

A complete beginner-to-intermediate guide to understanding how charts summarize price action, including line charts, bar charts, candlesticks, and data intervals.

Feb 4, 2026

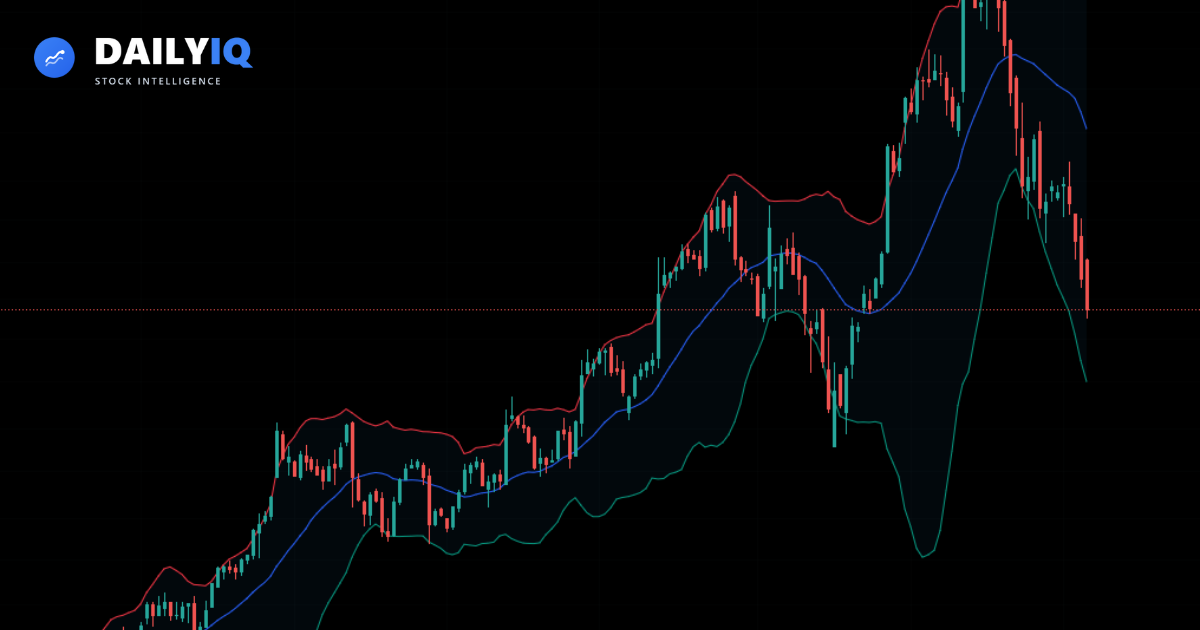

What Are Bollinger Bands and How to Read Them

Learn how Bollinger Bands measure volatility, identify breakouts, and highlight overextended price conditions.

Feb 3, 2026

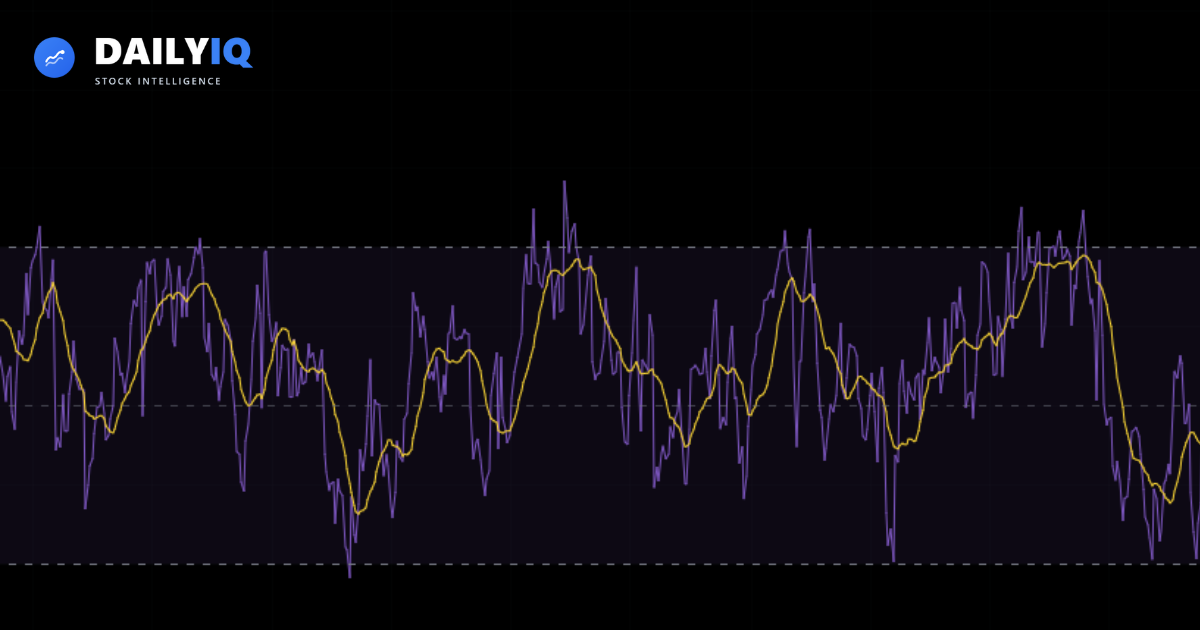

What Is RSI and How to Read It

Learn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.

Jan 30, 2026

What Is EMA and How to Read It

Learn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.

Feb 3, 2026

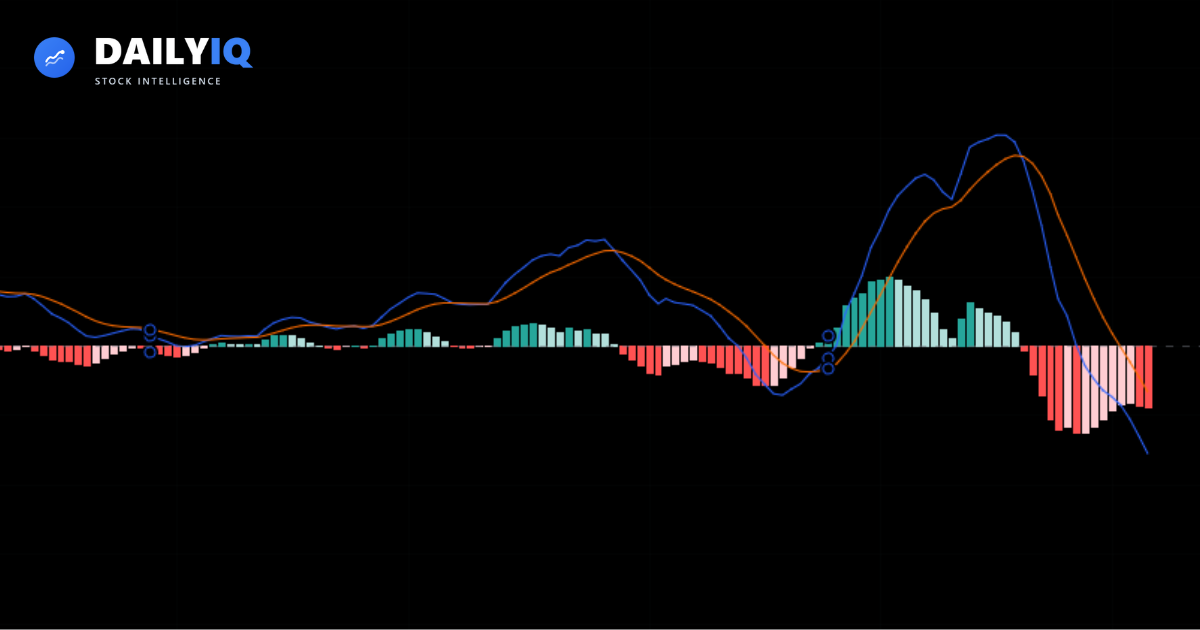

Understanding MACD: A Beginner's Guide

Learn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.

Jan 28, 2026

What Are Heikin Ashi Candles and How to Read Them

Learn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.

Feb 3, 2026

What Is ATR and How to Use It

Learn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.

Feb 3, 2026

How Is Bitcoin Priced?

Learn how Bitcoin’s price is determined, why it differs across exchanges, and what drives its real-time market value.

Feb 3, 2026

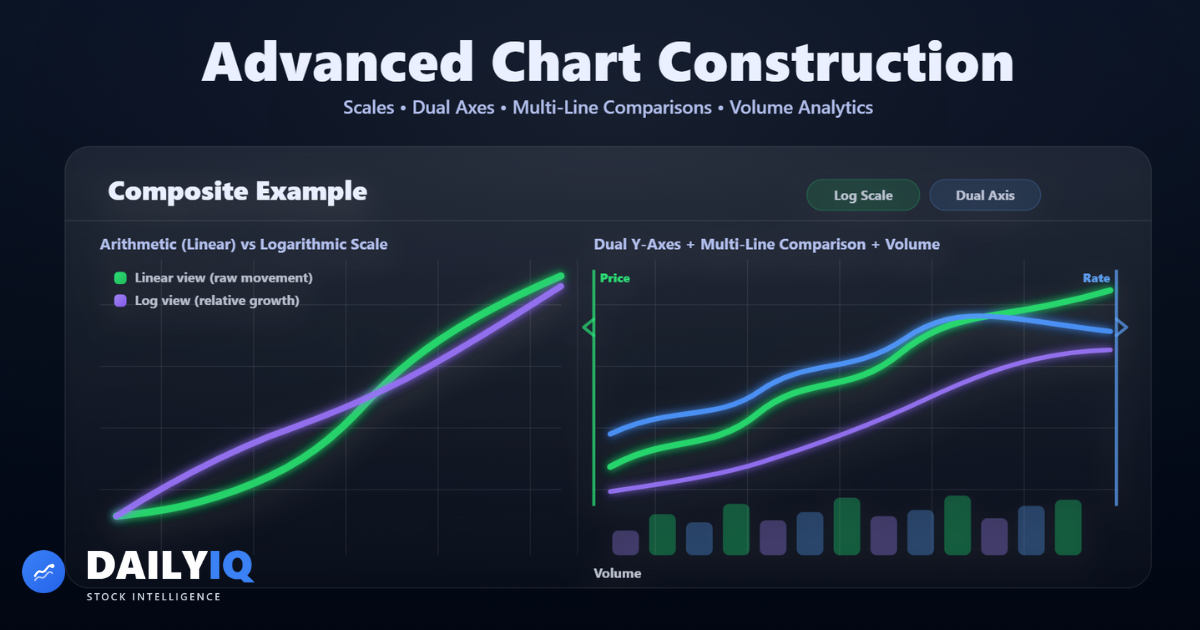

Advanced Chart Analysis: Scaling, Volume, and Comparative Charting Explained

A comprehensive guide to advanced chart construction including arithmetic vs logarithmic scales, dual y-axes, multi-line comparisons, and volume-based charting techniques.

Feb 7, 2026Want to Learn More?

Explore our glossary and FAQ to build your investing foundation.