What Are Bollinger Bands and How to Read Them

Learn how Bollinger Bands measure volatility, identify breakouts, and highlight overextended price conditions.

Introduction To What Are Bollinger Bands and How to Read Them

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

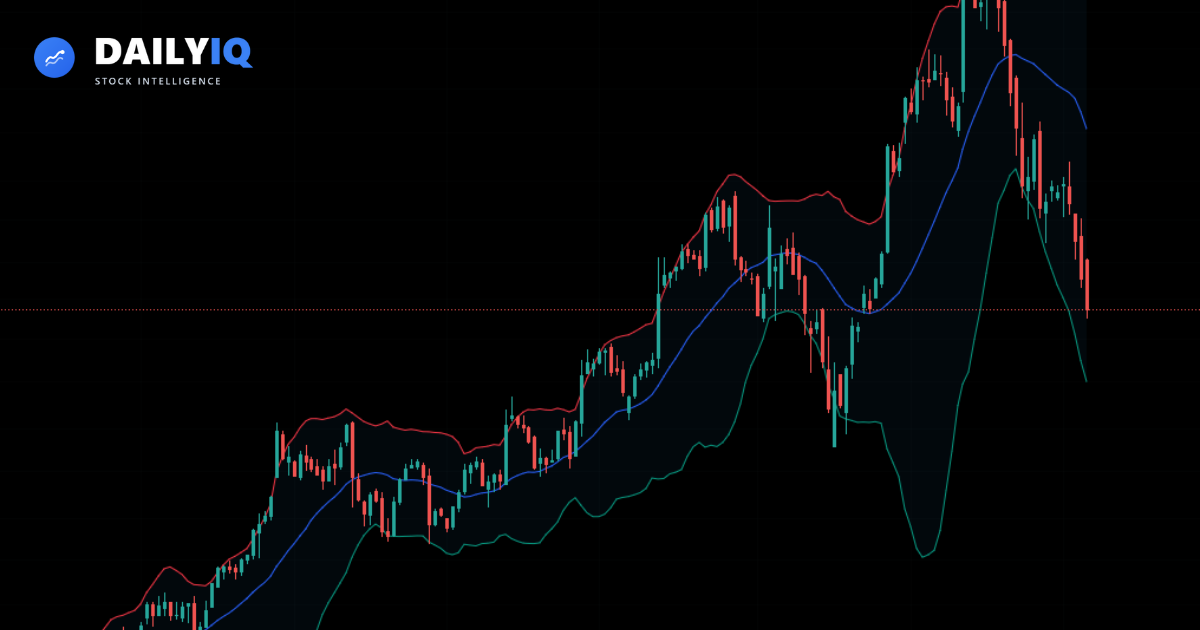

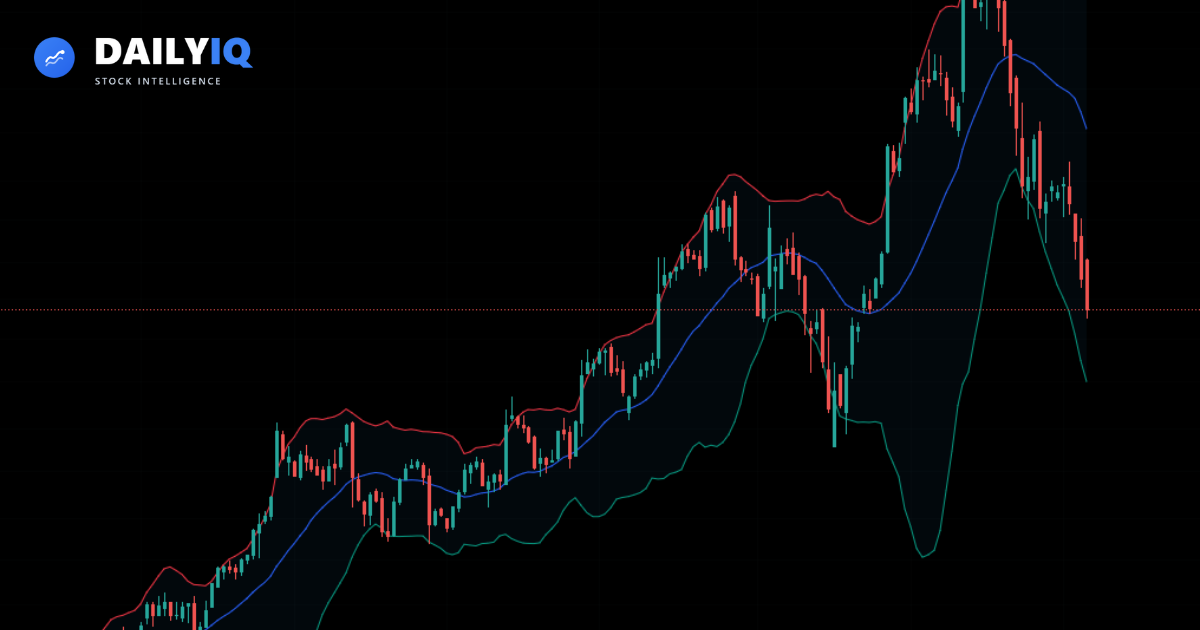

Bollinger Bands are one of the most widely used volatility indicators in technical analysis. They help traders understand when price movement is expanding, contracting, or becoming stretched relative to its recent average. Unlike momentum indicators such as RSI, Bollinger Bands focus on volatility — how much price is moving — rather than just direction.

The indicator consists of three lines:

- A middle line (typically a 20-period moving average)

- An upper band

- A lower band

The upper and lower bands expand when volatility increases and contract when volatility decreases.

This helps traders answer an important question:

- Is price becoming unusually extended relative to recent behavior?

- Bollinger Bands do not predict direction by themselves. Instead, they provide structure and context around price movement.

How Bollinger Bands work

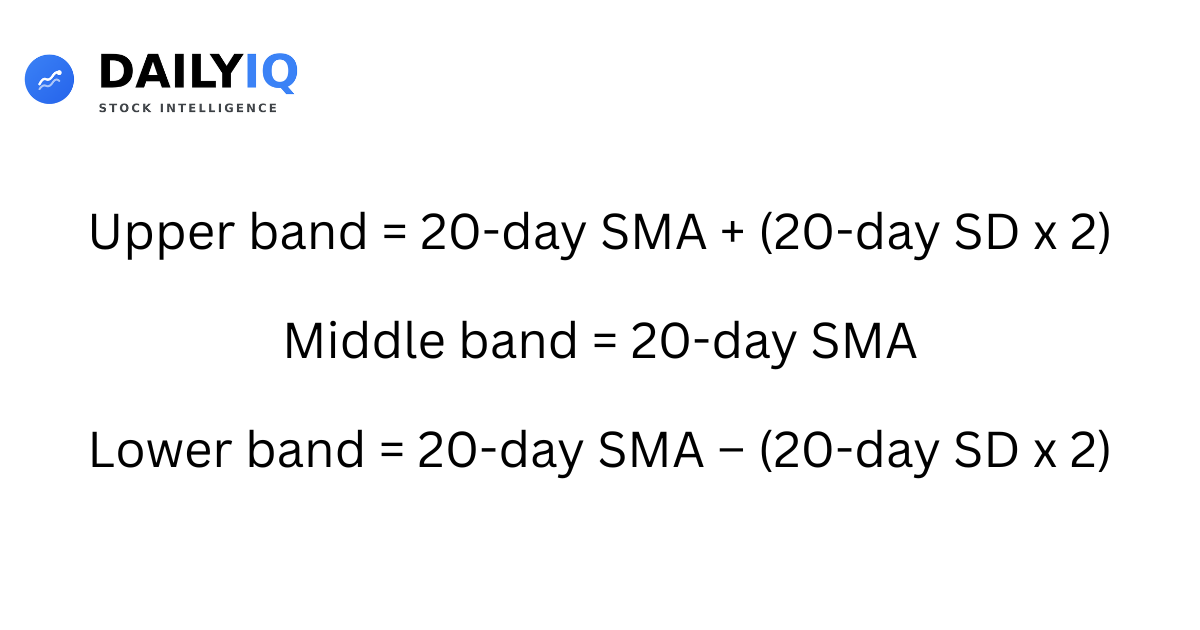

Bollinger Bands are calculated using two key components:

- A moving average (most commonly 20 periods)

- Standard deviation (typically set to 2)

The formula is:

Upper Band = Moving Average + (2 × Standard Deviation)

Lower Band = Moving Average − (2 × Standard Deviation)

Standard deviation measures how far price typically moves away from its average. When price swings grow larger, standard deviation increases and the bands widen. When price movement tightens, standard deviation decreases and the bands narrow.

Because the bands adjust dynamically, they reflect real-time volatility instead of fixed levels.

When volatility rises → bands widen.

When volatility falls → bands tighten.

Reading Bollinger Band signals

Bollinger Bands are commonly interpreted in three primary ways:

- Band touches

- The squeeze

- Breakout expansion

Price touching the upper band

When price reaches or closes near the upper band, it signals strong upside pressure relative to recent volatility.

However, touching the upper band does not automatically mean price will reverse.

In strong uptrends:

- Price can “ride the upper band” for extended periods.

- Multiple touches may confirm trend strength.

- Selling too early can mean exiting strong momentum.

In sideways markets:

- Upper band touches may signal short-term overextension.

- Price may rotate back toward the middle band.

Context determines whether a band touch reflects strength or exhaustion.

Price touching the lower band

When price reaches or closes near the lower band, it signals strong downside pressure.

In range-bound markets:

- Lower band touches can lead to short-term rebounds.

In strong downtrends:

- Price may continue hugging the lower band.

- Oversold conditions can persist longer than expected.

Band touches show volatility expansion — not guaranteed reversal.

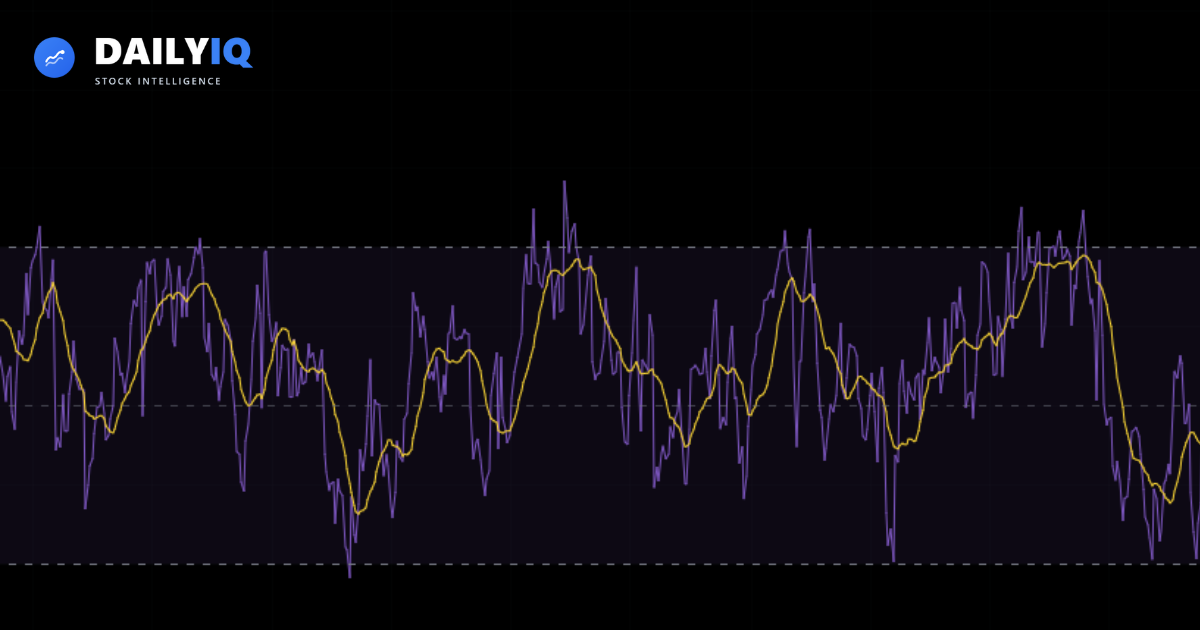

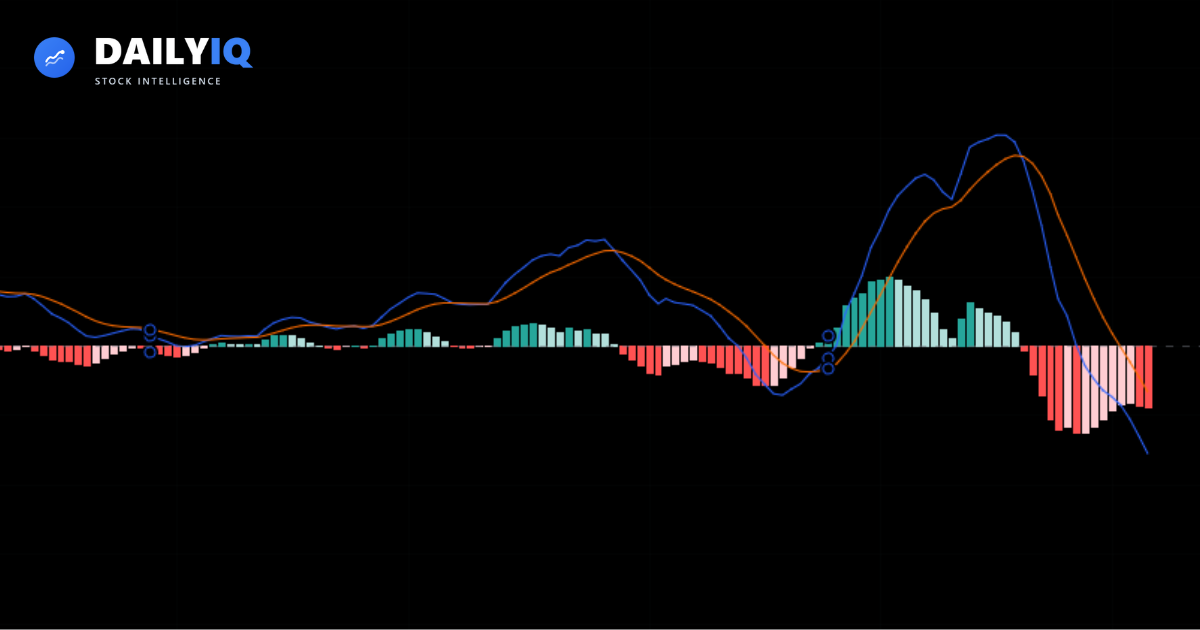

The Bollinger Band squeeze

One of the most powerful concepts in Bollinger Band analysis is the squeeze.

A squeeze occurs when the bands contract significantly due to declining volatility.

Low volatility often precedes high volatility.

When the bands tighten:

- Market movement has compressed.

- Energy is building.

- A breakout may follow.

The squeeze does not tell you which direction price will move — only that expansion is likely.

Traders often combine squeeze setups with:

- Volume confirmation

- Breakout above resistance or below support

- Trend alignment from moving averages

The key idea: contraction often leads to expansion.

The middle band (moving average)

The middle band acts as a dynamic reference point.

In uptrends:

- Pullbacks often find support near the middle band.

- It can act as a continuation entry area.

In downtrends:

- Rallies may fail near the middle band.

- It can act as dynamic resistance.

Rather than focusing only on the outer bands, many traders watch how price reacts to the middle band within trends.

Bollinger Bands in trending vs ranging markets

Bollinger Bands behave differently depending on market structure.

In range-bound markets:

- Price often oscillates between upper and lower bands.

- Mean reversion strategies may work better.

In strong trending markets:

- Price may repeatedly touch one band.

- Reversal signals become less reliable.

- The middle band becomes more important than the outer bands.

Understanding whether the market is trending or ranging prevents misinterpretation.

Bollinger Bands vs other indicators

Bollinger Bands measure volatility — not momentum or direction.

Because of this, traders often combine them with:

- RSI (to measure momentum strength)

- Moving averages (to confirm trend direction)

- Volume analysis (to validate breakout strength)

- MACD (to compare momentum acceleration)

For example:

- A band squeeze + rising volume may confirm breakout potential.

- Upper band touch + bearish RSI divergence may signal weakening momentum.

Volatility and momentum together provide stronger insight.

How DailyIQ uses Bollinger Bands

DailyIQ includes Bollinger Bands within its broader Technical Score framework.

Instead of treating band touches as automatic buy or sell signals, DailyIQ evaluates:

- Volatility expansion vs contraction

- Trend alignment

- Volume confirmation

- Momentum indicators such as RSI and MACD

For example:

- A squeeze combined with bullish structure may increase breakout probability.

- Repeated upper band touches in a strong uptrend may confirm strength.

- Volatility expansion with weakening momentum may signal caution.

Bollinger Bands are used as a volatility filter, not a standalone trigger.

Best practices

- Do not assume band touches equal reversals.

- Identify the primary trend first.

- Watch for squeezes before large moves.

- Combine with momentum confirmation.

- Use the middle band for continuation setups.

- Always apply risk management.

Bollinger Bands show volatility shifts — not certainty.

Trend Context First

Use What Are Bollinger Bands and How to Read Them with trend context instead of as a standalone trigger.

Bollinger Bands help traders visualize volatility in real time. By expanding and contracting with price movement, they highlight when conditions are compressed, expanding, or stretched relative to recent behavior.

Band touches, squeezes, and volatility expansions provide structure — but only when interpreted within overall market context.

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

When used alongside trend analysis, momentum indicators, and proper risk management, Bollinger Bands can improve timing and help traders recognize when volatility is building or fading.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

Volatility does not predict direction — but it often signals when a larger move may be approaching.

Quick FAQ

Does touching the upper or lower band mean reversal?

Not by itself. In strong trends, price can ride a band for longer than expected. Treat touches as context, then confirm with structure and momentum.

How do I trade a Bollinger squeeze better?

Wait for expansion plus confirmation: breakout level, volume pickup, and trend alignment. A squeeze signals potential movement, not guaranteed direction.

Are default settings always best?

20 periods and 2 standard deviations are a good baseline, but settings should match asset volatility and timeframe. Optimize for consistency, not maximum signal count.

What works better in trends: bands or middle line?

In trends, the middle line often provides cleaner continuation context than raw outer-band touches. Outer bands are more useful for volatility state and extension.

What confirms a high-quality Bollinger setup?

Trend structure, momentum agreement, and clean invalidation levels. Without those, band signals are easier to misread.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing What Are Bollinger Bands and How to Read Them.

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read

Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read