How Is Bitcoin Priced?

Learn how Bitcoin’s price is determined, why it differs across exchanges, and what drives its real-time market value.

Introduction To How Is Bitcoin Priced?

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

Bitcoin does not have a central bank.

It does not have an official pricing authority.

There is no single company that decides what Bitcoin is worth.

So how is Bitcoin priced?

The short answer is simple:

Bitcoin’s price is determined by supply and demand on exchanges.

But the full explanation is more interesting.

Bitcoin trades 24/7 on hundreds of exchanges worldwide. The price you see at any moment reflects the most recent transaction between a buyer and a seller.

Bitcoin’s price is not set.

It is discovered.

Where Bitcoin’s price comes from

Bitcoin trades on cryptocurrency exchanges such as:

- Coinbase

- Binance

- Kraken

- Bitstamp

- Bybit

Each exchange operates its own order book.

An order book contains:

- Buy orders (bids)

- Sell orders (asks)

The current price is simply the price at which the most recent trade occurred.

If buyers are willing to pay higher prices, Bitcoin rises.

If sellers accept lower prices, Bitcoin falls.

No authority adjusts it. The market determines it.

Why prices differ across exchanges

Bitcoin does not have one universal price.

Different exchanges may show slightly different prices at the same time.

This happens because:

- Liquidity differs across platforms

- Trading volume varies

- Fees differ

- Geographic demand varies

However, large price differences rarely last long.

Professional traders and algorithms use arbitrage — buying Bitcoin on one exchange and selling it on another — to eliminate pricing gaps.

This keeps global prices relatively aligned.

Supply and demand mechanics

Bitcoin’s total supply is capped at 21 million coins.

However, the circulating supply (coins actively available for trading) is smaller.

Price increases when:

- Demand increases

- Buyers aggressively lift sell orders

- New capital enters the market

Price decreases when:

- Selling pressure increases

- Large holders liquidate positions

- Demand weakens

Like any market, Bitcoin responds to order flow in real time.

The role of market liquidity

Liquidity affects how easily Bitcoin’s price moves.

In highly liquid markets:

- Large trades cause smaller price impact

- Price movements are smoother

In low-liquidity environments:

- Even moderate trades can cause sharp moves

- Volatility increases

Bitcoin is generally highly liquid compared to smaller cryptocurrencies, but liquidity still varies by exchange and time of day.

Spot vs futures pricing

Bitcoin trades in two major markets:

-

Spot market

- Actual Bitcoin is bought and sold

- Immediate settlement

-

Futures market

- Contracts representing future delivery

- Often used for leverage and speculation

Sometimes futures prices trade above spot (called a premium).

Sometimes below spot (called a discount).

Futures pricing can influence short-term volatility, especially during liquidations.

However, long-term price discovery still centers around supply and demand.

What drives Bitcoin demand?

Several factors influence demand:

- Institutional investment

- Retail adoption

- ETF flows

- Macroeconomic conditions

- Interest rates

- Inflation expectations

- Regulatory developments

- Media coverage

- Market sentiment

Bitcoin often reacts to:

- Federal Reserve policy changes

- Risk-on vs risk-off environments

- Major economic events

Although Bitcoin is decentralized, it still interacts with global financial conditions.

Mining and new supply

New Bitcoin enters circulation through mining.

Miners validate transactions and are rewarded with newly created Bitcoin.

However, the rate of new supply decreases over time through an event called the halving, which occurs roughly every four years.

During a halving:

- Mining rewards are cut in half

- New supply entering the market decreases

Reduced supply growth can impact price if demand remains steady or increases.

Market psychology and momentum

Beyond pure supply and demand, Bitcoin pricing is heavily influenced by sentiment.

Bitcoin is a volatile asset.

Price movements are often amplified by:

- Fear of missing out (FOMO)

- Panic selling

- Liquidations

- Leverage

- Social media narratives

Because Bitcoin trades 24/7 globally, reactions to news can occur instantly.

Momentum can drive rapid price swings in both directions.

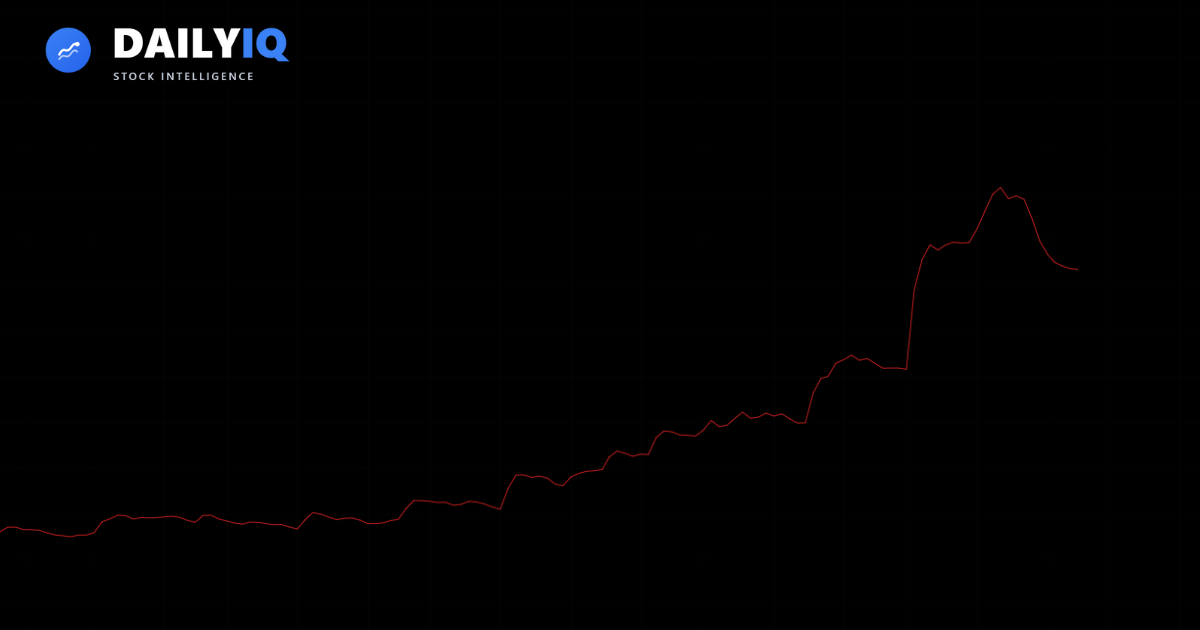

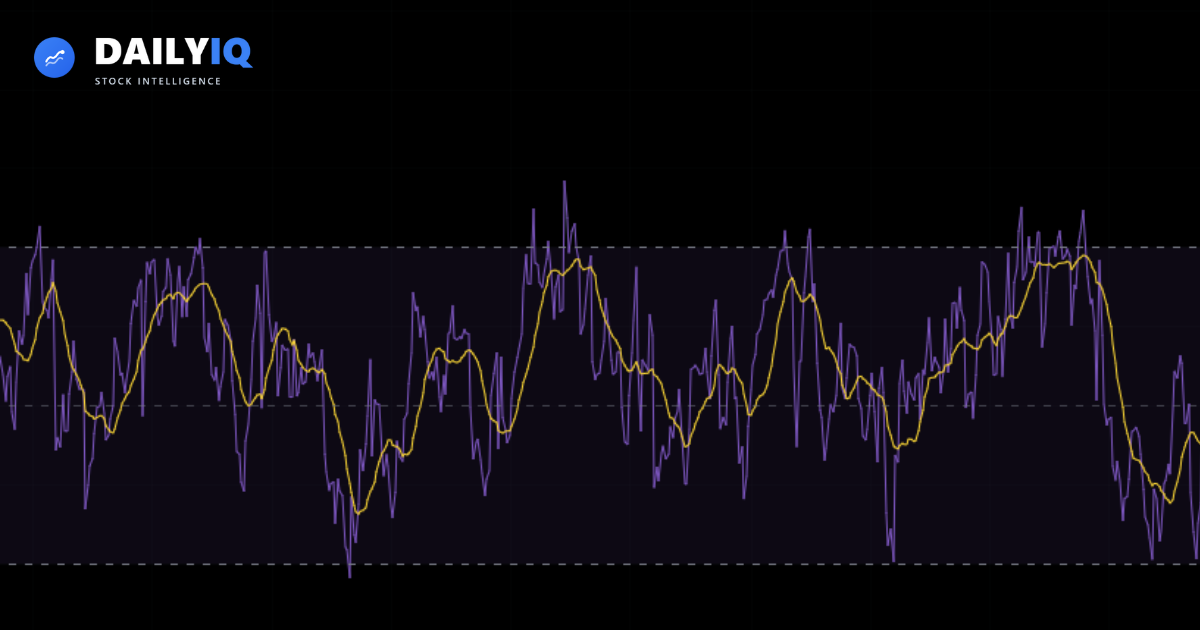

How DailyIQ tracks Bitcoin pricing

DailyIQ monitors Bitcoin pricing across exchanges and incorporates:

- Real-time spot price data

- Volatility metrics (ATR)

- Trend indicators (EMA)

- Momentum indicators (RSI)

- Volume shifts

Rather than reacting to price alone, DailyIQ evaluates:

- Trend strength

- Volatility expansion

- Market structure

- Multi-timeframe alignment

This provides context around price rather than treating price as a standalone signal.

Common misconceptions

“Bitcoin has a fixed price.”

False. It changes every second based on trades.

“One exchange controls Bitcoin’s value.”

False. Price is determined across global markets.

“Bitcoin price is arbitrary.”

Not exactly. It reflects real-time supply, demand, liquidity, and sentiment.

Trend Context First

Use How Is Bitcoin Priced? with trend context instead of as a standalone trigger.

Bitcoin is priced through continuous global market activity. There is no central authority setting its value.

The price you see is simply the most recent agreement between a buyer and a seller.

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

Supply is limited.

Demand fluctuates.

Liquidity varies.

Sentiment shifts.

All of these forces interact to determine Bitcoin’s real-time market value.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

Bitcoin’s price is not declared — it is discovered every second of every day.

Quick FAQ

Why is Bitcoin priced differently across exchanges?

Each venue has its own order book, liquidity, fees, and local demand. Arbitrage usually narrows gaps, but short-lived differences are normal.

Which Bitcoin price should I trust for execution?

Use the price on the exchange where you are actually trading. For analysis, use an index or composite feed to avoid single-venue noise.

How do futures and funding affect spot price behavior?

Leveraged futures can amplify short-term moves through liquidations. They do not replace spot supply-demand, but they can accelerate volatility around key levels.

When is Bitcoin most prone to sharp moves?

During low-liquidity windows, major macro news, and periods of crowded leverage. Thin books plus forced positioning can create outsized candles.

How can I avoid poor entries in fast crypto markets?

Use limit orders when possible, define invalidation before entry, and size smaller during volatility expansion. Execution quality matters as much as direction.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing How Is Bitcoin Priced?.

What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read

What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read