What Is ATR and How to Use It

Learn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.

Introduction To What Is ATR and How to Use It

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

The Average True Range (ATR) is a volatility indicator used to measure how much an asset typically moves over a given period.

Unlike RSI or EMA, ATR does not measure direction. It does not tell you whether price will go up or down.

Instead, ATR answers a different question:

How much is price moving?

By measuring volatility, ATR helps traders:

- Set realistic stop losses

- Adjust position size

- Identify expanding or contracting market conditions

ATR focuses on movement size — not trend bias.

How ATR works

ATR is typically calculated using 14 periods, though traders can adjust this setting depending on timeframe and strategy.

ATR begins with a value called True Range (TR).

True Range is the greatest of:

- Current High − Current Low

- Absolute value of Current High − Previous Close

- Absolute value of Current Low − Previous Close

This ensures that gaps and large overnight moves are included in the calculation.

ATR is then calculated as the smoothed average of True Range over the chosen lookback period.

For example:

- A 14-day ATR on a daily chart measures the average daily movement over 14 trading days.

- A 14-period ATR on a 1-hour chart measures the average hourly movement.

The result appears as a single line below price that rises and falls with volatility.

Reading ATR

ATR does not produce buy or sell signals on its own.

Instead, it tells you whether volatility is:

- Increasing

- Decreasing

- Stable

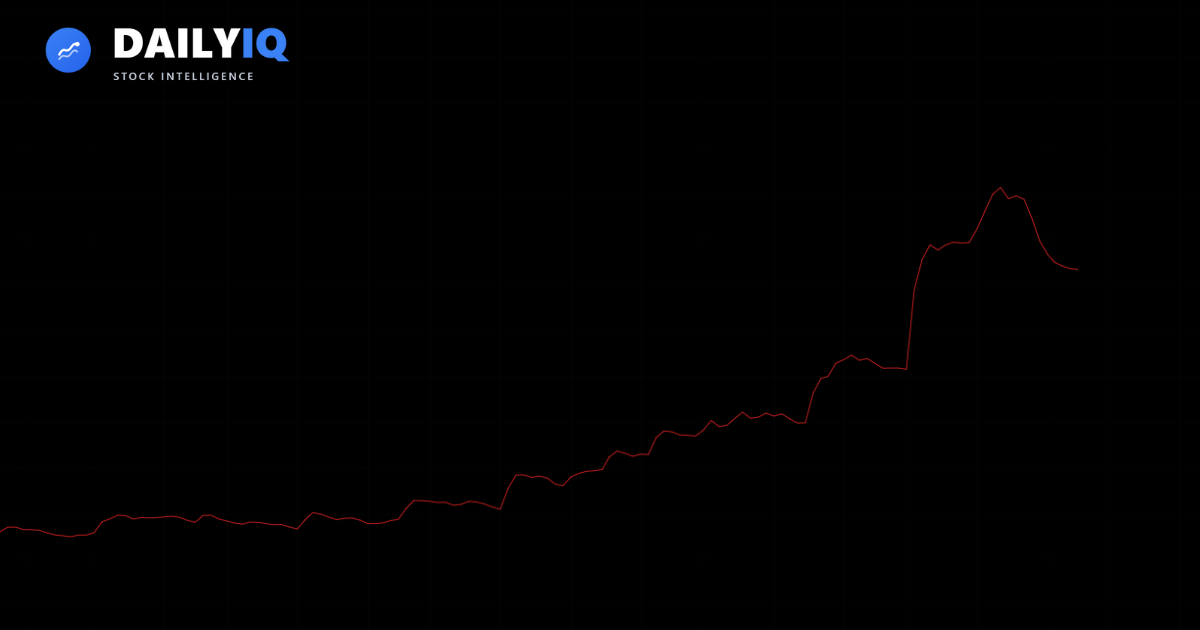

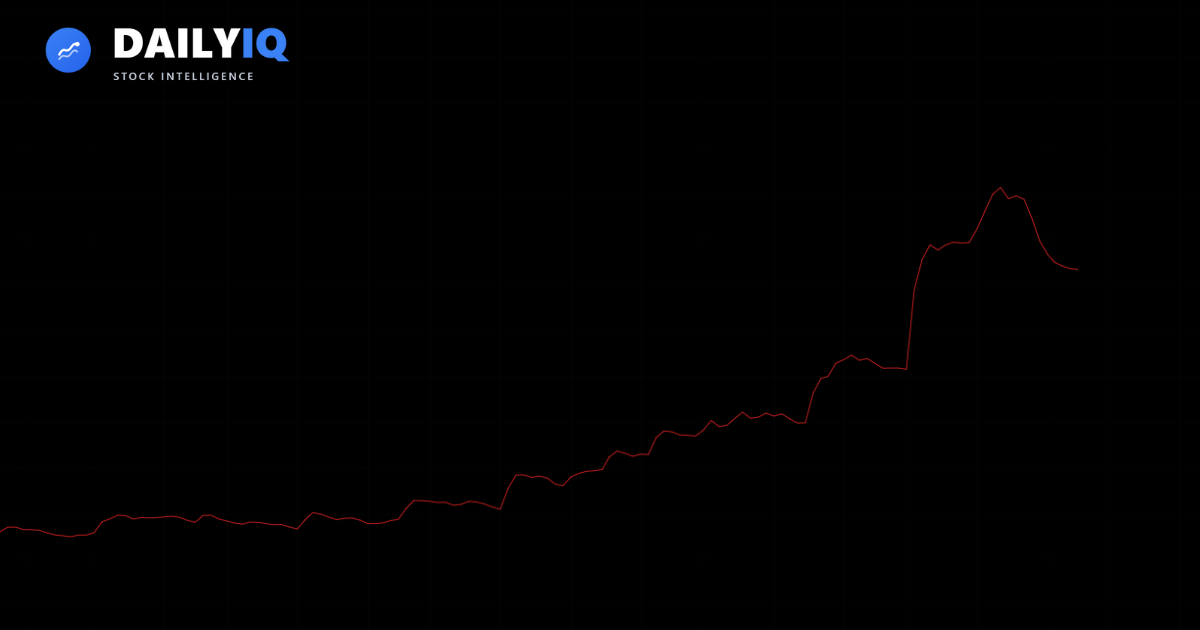

Rising ATR

When ATR increases:

- Price swings are expanding.

- Volatility is rising.

- Breakouts or strong moves may be developing.

Rising ATR often appears during:

- Trend acceleration

- Earnings releases

- Major news events

- Market panic

Higher ATR means larger candles and wider price movement.

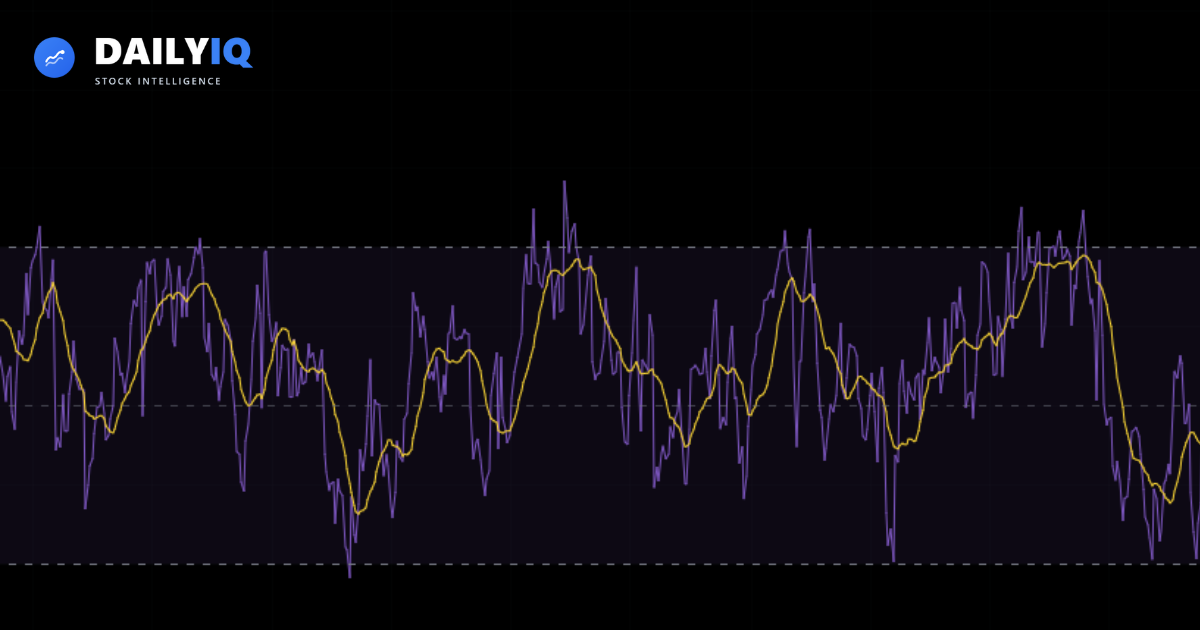

Falling ATR

When ATR decreases:

- Price movement is contracting.

- Market is consolidating.

- Breakouts are less likely.

Falling ATR often appears during:

- Sideways ranges

- Low-volume environments

- Trend exhaustion

Lower ATR reflects tighter, quieter price action.

ATR and stop losses

One of ATR’s most practical uses is setting stop losses.

Instead of placing stops at arbitrary distances, many traders use multiples of ATR.

For example:

- 1 × ATR below entry

- 1.5 × ATR below entry

- 2 × ATR below entry

If a stock’s ATR is $2:

- A 2× ATR stop would be $4 away from entry.

This method adjusts stop distance based on real market volatility.

If volatility increases, stop distance widens.

If volatility decreases, stops naturally tighten.

ATR-based stops help prevent getting stopped out by normal market noise.

ATR and position sizing

ATR can also help manage risk through position sizing.

When volatility increases:

- Price moves are larger.

- Risk per share increases.

- Position size may need to decrease.

When volatility decreases:

- Price moves are smaller.

- Risk per share decreases.

- Position size may increase.

Using ATR keeps risk more consistent across different assets and conditions.

This approach is especially useful when trading:

- Futures

- Leveraged ETFs

- High-volatility stocks

ATR helps normalize risk exposure.

ATR in trending vs ranging markets

ATR behaves differently depending on market structure.

In strong trends:

- ATR often rises as price accelerates.

- Volatility expansion confirms momentum.

In range-bound markets:

- ATR gradually declines.

- Breakouts become less likely until volatility expands again.

A sharp increase in ATR after prolonged compression can signal the beginning of a new directional move.

However, ATR alone does not determine direction.

Volatility compression and expansion

Markets often cycle between:

- Volatility compression (low ATR)

- Volatility expansion (rising ATR)

A common pattern:

- ATR declines steadily during consolidation.

- Price tightens into a range.

- ATR begins rising as price breaks out.

This volatility shift often precedes sustained movement.

Recognizing compression and expansion cycles can improve trade timing.

ATR vs standard deviation

ATR and standard deviation both measure volatility, but differently.

ATR:

- Measures actual range movement.

- Includes price gaps.

- Widely used for stops and risk management.

Standard deviation:

- Measures dispersion from the mean.

- Used in Bollinger Bands.

- More statistically oriented.

ATR is typically preferred for practical trade management.

How DailyIQ uses ATR

DailyIQ incorporates ATR inside its broader Technical Score framework.

Rather than using ATR in isolation, it evaluates:

- ATR trend (rising or falling)

- Volatility expansion vs contraction

- Alignment with EMA structure

- Confirmation from RSI and momentum tools

- Multi-timeframe agreement

For example:

- Rising ATR with strong trend alignment increases conviction.

- Rising ATR during breakdown increases risk awareness.

- Declining ATR suggests range-bound conditions.

ATR provides volatility context that strengthens overall analysis.

Best practices

- Do not use ATR to predict direction.

- Use ATR to determine realistic stop distances.

- Consider ATR multiples for consistency.

- Watch for volatility expansion after prolonged compression.

- Adjust position size when ATR shifts significantly.

- Combine ATR with structure and momentum indicators.

ATR measures movement size — not certainty.

Trend Context First

Use What Is ATR and How to Use It with trend context instead of as a standalone trigger.

The Average True Range is a simple yet powerful volatility tool. By measuring how much price typically moves, it helps traders set smarter stops, manage position size, and adapt to changing market conditions.

Rising ATR signals expanding volatility.

Falling ATR signals contracting movement.

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

When used alongside trend indicators and structured risk management, ATR improves planning and decision-making.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

Volatility often shifts before trends fully develop.

ATR helps you recognize those shifts early and manage them intelligently.

Quick FAQ

Does ATR tell me whether price will go up or down?

No. ATR measures movement size, not direction. Pair it with trend tools for directional decisions.

How do I choose an ATR stop multiple?

Use a multiple that fits your strategy and typical noise for that asset and timeframe. Many traders start around 1.5x to 2x and calibrate from results.

How does ATR help with position sizing?

Higher ATR means wider expected movement, so position size should typically be smaller to keep dollar risk consistent. Lower ATR can allow larger size.

What does a sudden ATR spike usually mean?

Volatility expansion from breakout, panic, or event-driven repricing. It often signals regime change and calls for stricter risk control.

Can ATR be used for take-profit planning?

Yes. ATR can frame realistic target ranges so exits reflect current volatility instead of arbitrary fixed distances.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing What Is ATR and How to Use It.

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read

What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read