What Is EMA and How to Read It

Learn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.

Introduction To What Is EMA and How to Read It

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

The Exponential Moving Average (EMA) is one of the most widely used trend indicators in technical analysis. It helps traders identify the direction of a trend and determine whether momentum is strengthening or weakening.

Unlike price itself, which can be noisy and volatile, the EMA smooths price data to reveal the underlying trend. What makes EMA different from other moving averages is that it gives more weight to recent prices. This makes it more responsive to new market information.

When price accelerates upward, the EMA rises faster.

When price falls sharply, the EMA turns downward more quickly.

The EMA helps answer a key question:

Is price trending, consolidating, or beginning to shift direction?

The EMA does not predict the future. Instead, it provides structure — helping traders align with trends rather than trade against them.

How EMA works

The Exponential Moving Average is calculated using a smoothing formula that emphasizes recent price action.

The formula is:

EMA = (Current Price × Multiplier) + (Previous EMA × (1 - Multiplier))

Where:

Multiplier = 2 / (Period + 1)

For example:

- A 9-period EMA reacts quickly to short-term price changes.

- A 21-period EMA reflects short-to-medium momentum.

- A 50-period EMA tracks intermediate trends.

- A 200-period EMA reflects long-term market structure.

Because recent prices receive more weight, the EMA adjusts faster than a Simple Moving Average (SMA).

Shorter EMAs move quickly and react to minor shifts.

Longer EMAs move slowly and filter out noise.

This balance allows traders to select EMAs based on their timeframe and strategy.

Reading EMA signals

EMAs are typically used in three main ways: trend identification, dynamic support and resistance, and crossover signals.

Trend direction

The most basic use of EMA is identifying trend direction.

In an uptrend:

- Price remains above the EMA.

- The EMA slopes upward.

In a downtrend:

- Price remains below the EMA.

- The EMA slopes downward.

In consolidation:

- Price moves back and forth across the EMA.

- The EMA flattens.

The slope of the EMA matters just as much as price location:

- Rising EMA → bullish momentum

- Falling EMA → bearish momentum

- Flat EMA → range-bound conditions

Dynamic support and resistance

EMAs often act as dynamic support or resistance.

In strong uptrends:

- Price may pull back toward the EMA.

- The EMA acts as a moving support level.

- Buyers often step in near the EMA.

In strong downtrends:

- Price may rally toward the EMA.

- The EMA acts as dynamic resistance.

- Sellers may defend that area.

Unlike horizontal levels, EMAs adjust over time as price evolves.

This makes them particularly useful in trending markets.

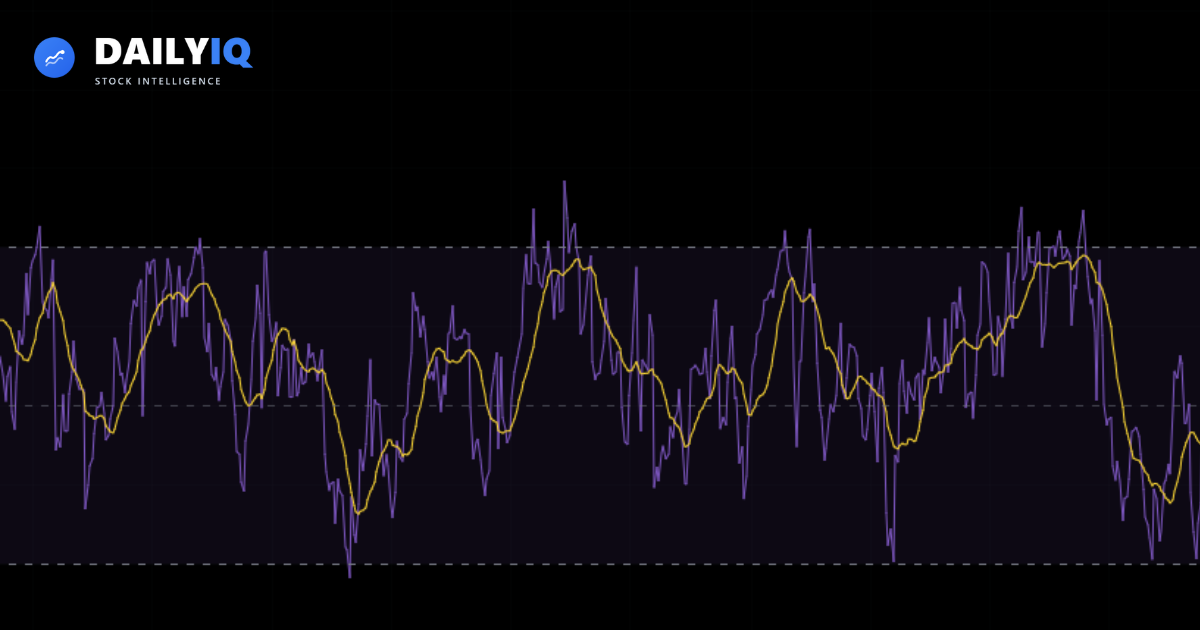

EMA crossovers

A common approach uses two EMAs — one short-term and one longer-term.

For example:

- 9 EMA (fast)

- 21 EMA (slow)

When the short EMA crosses above the longer EMA:

- This is called a bullish crossover.

- It may signal strengthening upside momentum.

When the short EMA crosses below the longer EMA:

- This is called a bearish crossover.

- It may signal strengthening downside momentum.

However, crossovers can produce false signals in choppy markets. They tend to work best in sustained trends.

EMA in trending vs ranging markets

EMA behaves differently depending on market structure.

In strong trending markets:

- EMA often provides clean pullback entries.

- Price respects the EMA as dynamic support or resistance.

- Crossovers can confirm trend continuation.

In range-bound markets:

- Price frequently crosses above and below the EMA.

- Crossovers may generate false signals.

- The EMA flattens and loses directional value.

Understanding whether a market is trending or ranging helps determine how reliable EMA signals may be.

EMA vs SMA

Both EMA and SMA smooth price, but they differ in responsiveness.

Simple Moving Average (SMA):

- Gives equal weight to all periods.

- Slower to respond to price changes.

- Often smoother and more stable.

Exponential Moving Average (EMA):

- Gives more weight to recent price.

- Responds faster to changes.

- Better suited for active traders.

Traders often prefer EMA when they want quicker reaction to momentum shifts.

Using multiple EMAs

Many traders stack multiple EMAs to analyze trend strength.

For example:

- 9 EMA (short-term momentum)

- 21 EMA (intermediate momentum)

- 50 EMA (trend structure)

- 200 EMA (long-term bias)

When shorter EMAs are above longer EMAs and all slope upward:

- Trend alignment is strong.

When shorter EMAs cross below longer EMAs:

- Momentum may be weakening.

EMA alignment can provide structure beyond a single line.

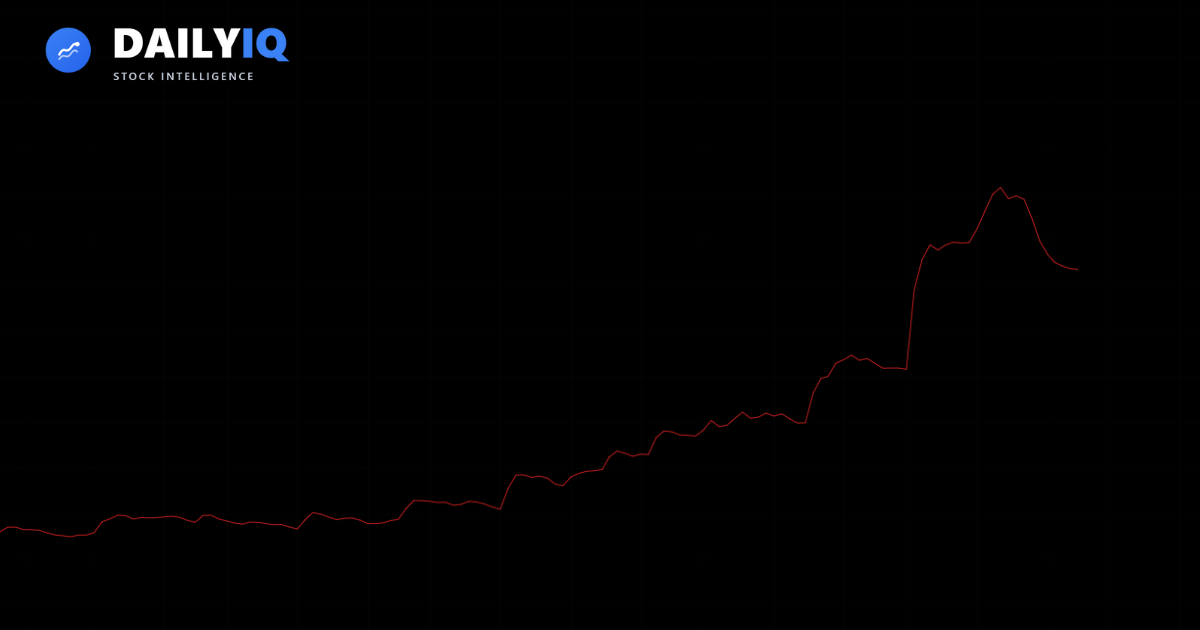

EMA and momentum shifts

One subtle but powerful signal comes from EMA slope change.

When EMA begins flattening after a strong trend:

- Momentum may be slowing.

When EMA starts turning in the opposite direction:

- A trend transition may be developing.

EMA slope changes often occur before obvious trend reversals.

However, they require confirmation from price structure and volume.

How DailyIQ uses EMA

DailyIQ includes EMA as a core component within its broader Technical Score system.

Rather than treating EMA crossovers as automatic buy or sell signals, DailyIQ evaluates EMA alongside:

- Market structure

- Volatility conditions

- Momentum indicators

- Volume confirmation

- Broader trend alignment

For example:

- Price above rising 50 EMA may support a bullish bias.

- Price breaking below 50 EMA with weakening momentum may increase caution.

- EMA alignment across timeframes strengthens conviction.

EMA becomes more powerful when combined with structure and risk management.

Best practices

- Identify the primary trend first.

- Use EMA as a guide, not a guarantee.

- Combine EMA with support and resistance levels.

- Avoid overreacting to minor crossovers in choppy markets.

- Confirm EMA signals with volume or momentum tools.

- Match EMA length to your timeframe.

Most importantly, remember that EMA follows price — it does not lead it.

Trend Context First

Use What Is EMA and How to Read It with trend context instead of as a standalone trigger.

The Exponential Moving Average is a simple but powerful tool for identifying trend direction and momentum shifts.

By giving more weight to recent prices, EMA reacts quickly to new market information while still smoothing out noise. It can act as dynamic support or resistance, highlight trend strength, and signal potential shifts through crossovers or slope changes.

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

When used alongside structure, momentum, and risk management, EMA helps traders stay aligned with the dominant trend instead of fighting it.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

Trends rarely move in straight lines — but EMA helps you see the path more clearly.

Quick FAQ

Which EMA lengths should I start with?

A common starting set is 9/21 for short-term momentum, 50 for trend structure, and 200 for long-term bias. Adjust only if your timeframe requires it.

Are EMA crossovers enough to trade on their own?

Usually no. Crossovers lag and can whipsaw in ranges. Confirm with price structure, market context, and risk-to-reward.

How do EMAs act as support or resistance?

In trends, pullbacks and rallies often react around key EMAs because many participants watch them. Treat them as dynamic zones, not exact lines.

How can I filter bad EMA signals in choppy markets?

Avoid low-slope, overlapping EMA conditions and require confirmation from higher timeframe trend or breakout structure.

What matters more: EMA slope or price crossing it?

Slope usually matters more for regime context. A rising EMA with price above it is stronger evidence than isolated crosses.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing What Is EMA and How to Read It.

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read

What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read

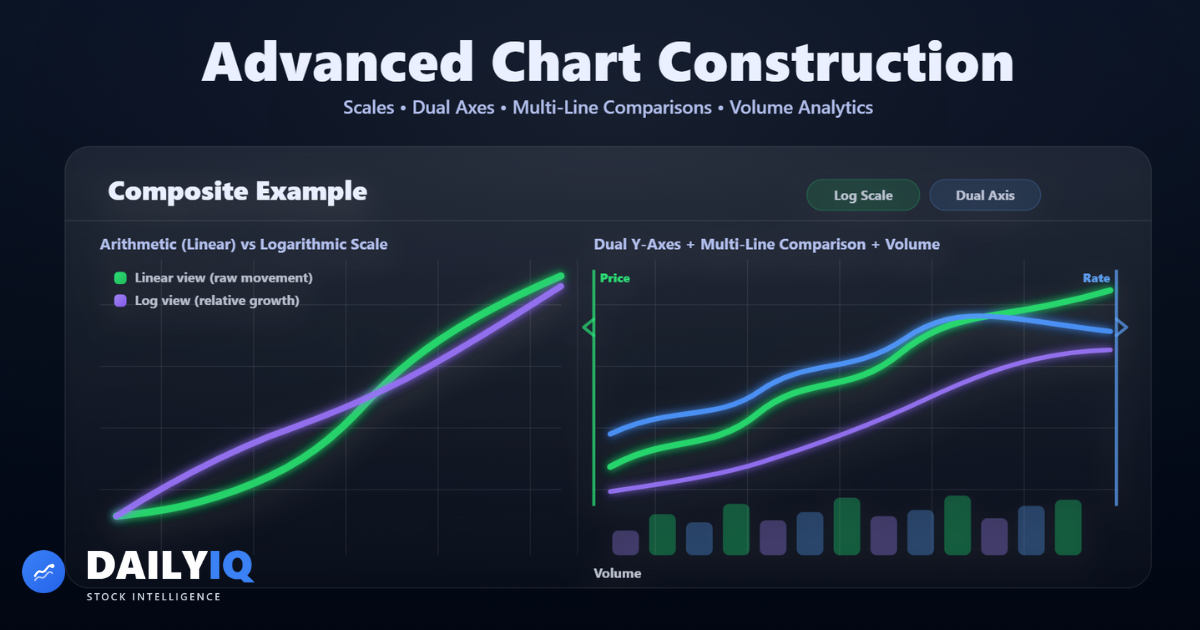

What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read Advanced Chart Analysis: Scaling, Volume, and Comparative Charting ExplainedA comprehensive guide to advanced chart construction including arithmetic vs logarithmic scales, dual y-axes, multi-line comparisons, and volume-based charting techniques.Technical · 22 min read

Advanced Chart Analysis: Scaling, Volume, and Comparative Charting ExplainedA comprehensive guide to advanced chart construction including arithmetic vs logarithmic scales, dual y-axes, multi-line comparisons, and volume-based charting techniques.Technical · 22 min read Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read

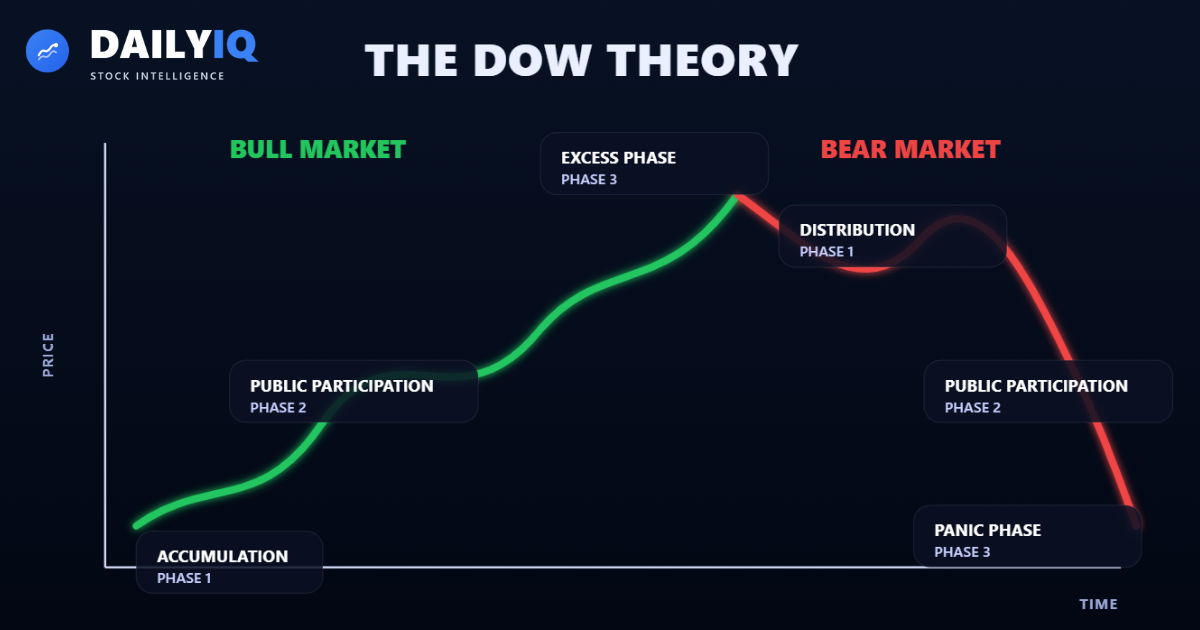

Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read