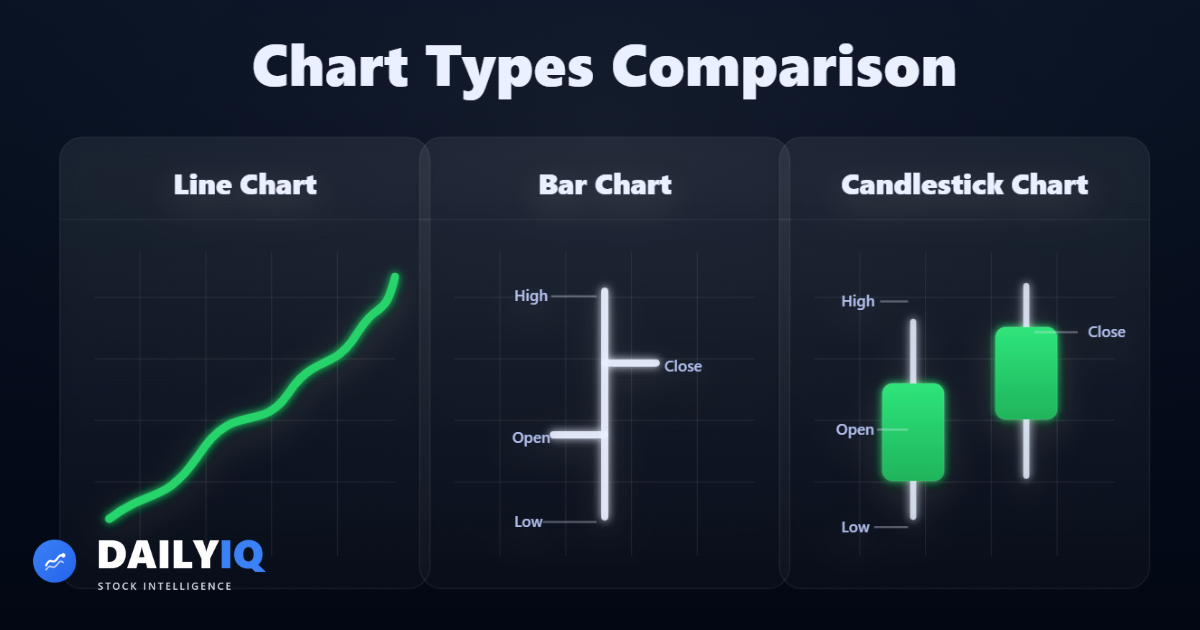

Introduction to Charts — Line, Bar & Candlestick Charts Explained

A complete beginner-to-intermediate guide to understanding how charts summarize price action, including line charts, bar charts, candlesticks, and data intervals.

Introduction To Introduction to Charts — Line, Bar & Candlestick Charts Explained

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

Why Charts Exist

Charts are the foundation of technical analysis because they transform raw numerical price data into visual structure. While a spreadsheet might show thousands of price records, the human brain processes patterns visually far more efficiently than through rows of numbers.

Every trade in a market represents an agreement between buyers and sellers. A chart captures those agreements over time. When plotted sequentially, price movement reveals rhythm, expansion, contraction, acceleration, hesitation, and exhaustion.

Charts are not just pictures — they are structured summaries of supply and demand.

They allow analysts to:

- Recognize trend direction quickly

- Detect shifts in momentum

- Identify volatility expansion

- Spot consolidation zones

- Observe psychological turning points

Without charts, technical analysis would not exist. Indicators, oscillators, and overlays are all built on chart data.

Charts do not predict the future. They organize the past in a way that improves decision-making.

Key Takeaways

- Charts convert numbers into structure

- They visualize supply and demand

- They highlight patterns humans detect naturally

- They form the base of all technical tools

- Understanding chart construction prevents misinterpretation

The Four Core Price Points (OHLC)

All advanced charting begins with four basic data points collected over a specific time interval.

These are:

- Open — the first trade in the interval

- High — the highest price reached

- Low — the lowest price reached

- Close — the final trade in the interval

Together, these four numbers summarize what happened during that period.

The relationship between open and close tells us directional bias. The distance between high and low tells us volatility. The position of the close within the range tells us conviction.

For example:

- Close near the high → buyers dominated

- Close near the low → sellers dominated

- Large range → high volatility

- Small range → compression

These four data points are the building blocks of both bar charts and candlestick charts.

Even the simplest line chart is usually built from the close.

Understanding OHLC is critical because:

- Indicators derive from them

- Patterns are defined by them

- Trend shifts are detected through them

Without knowing what data is being displayed, traders risk drawing incorrect conclusions.

Core Insights

- OHLC summarizes an entire time interval

- Each point carries structural meaning

- Volatility and conviction can be inferred

- All advanced charts are built from these values

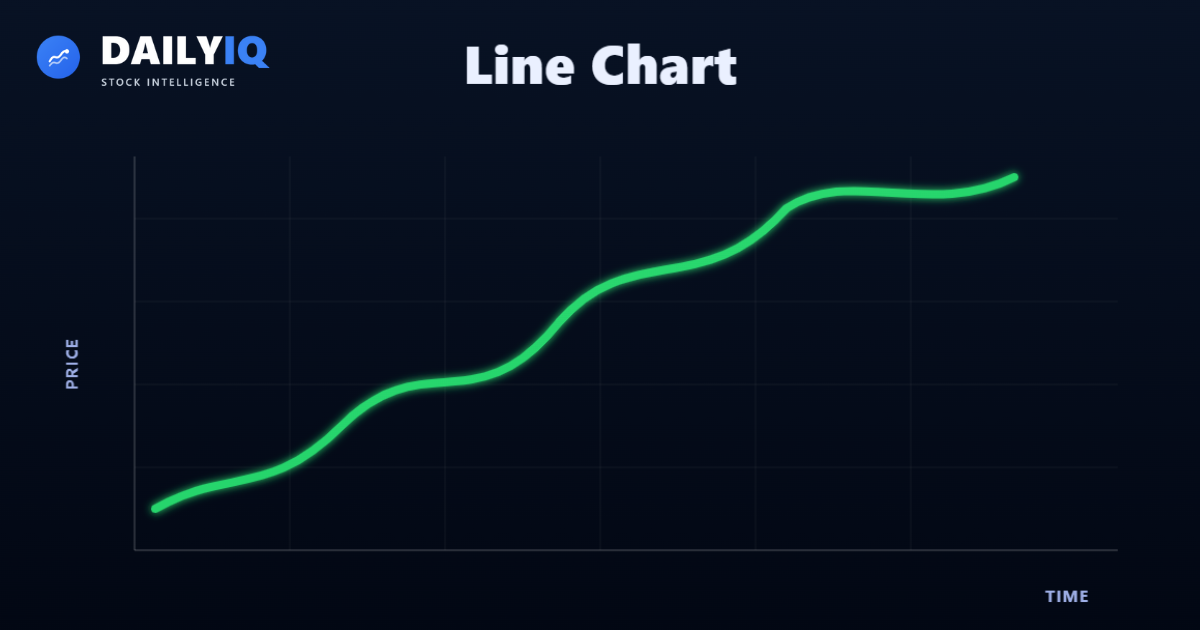

What Is a Line Chart?

A line chart is the simplest chart type. It connects one price per time interval — usually the closing price — with a continuous line.

Although it appears basic, it serves an important purpose: clarity.

By focusing only on closing prices, a line chart removes intraday noise and highlights overall direction. It sacrifices detail for smoothness.

This makes line charts particularly useful when analyzing:

- Long-term trends

- Index performance

- Multi-year structural moves

- Macro-level analysis

Because only one data point is used per interval, volatility inside the period is hidden. This is both a strength and a limitation.

Strength: it simplifies the story. Limitation: it hides internal movement.

Line charts are often preferred by investors who care about direction rather than intraday battle.

When to Use Line Charts

- Studying long-term movement

- Comparing asset performance

- Identifying macro trends

- Avoiding short-term noise

Limitations

- Does not show opening price

- Does not show volatility range

- Cannot reveal intraday reversals

What Is a Bar Chart?

A bar chart expands upon the line chart by incorporating all four OHLC price points.

Each vertical bar represents one time interval.

The components are:

- Top of bar → High

- Bottom of bar → Low

- Left tick → Open

- Right tick → Close

This structure provides significantly more information than a line chart.

Bar charts allow traders to evaluate:

- Intraday volatility

- Gap behavior

- Directional strength

- Reversal attempts

A longer vertical bar indicates greater range (volatility). A short bar suggests compression.

The relationship between the open and close can signal strength or weakness.

For example:

- Close above open → bullish session

- Close below open → bearish session

Bar charts balance information and simplicity. They are highly respected in professional trading environments.

Advantages

- Displays full range

- Shows open and close

- Reveals volatility

- Better for active trading

Limitations

- Less visually intuitive than candles

- Pattern recognition slightly harder

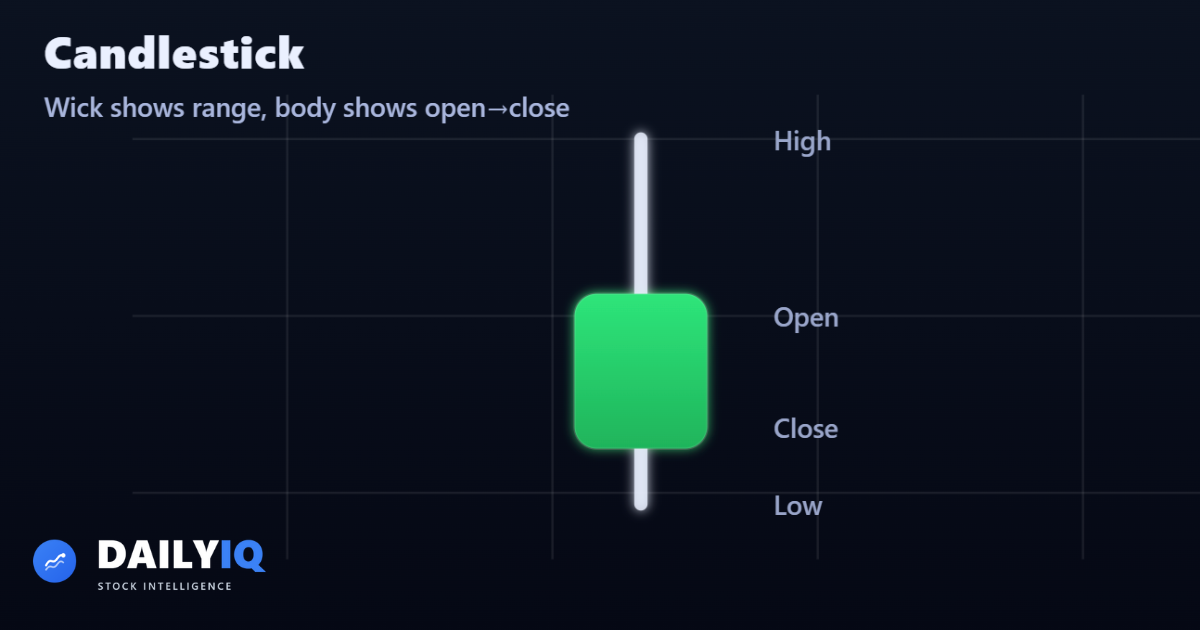

What Is a Candlestick Chart?

Candlestick charts present the same OHLC information as bar charts but in a more visually intuitive format.

Each candle contains:

- Real body → difference between open and close

- Upper shadow → high to body

- Lower shadow → low to body

If close > open → bullish candle If close < open → bearish candle

Candlesticks make pattern recognition easier because:

- Body size shows conviction

- Shadow length shows rejection

- Color differentiates bias

Large bodies suggest strong directional control. Long upper shadows suggest selling pressure. Long lower shadows suggest buying support.

Candlestick charts are widely used because they integrate price structure and psychology in one visual form.

Why Traders Prefer Candlesticks

- Easier pattern recognition

- Clearer trend shifts

- Emotional behavior visible

- Strong visual contrast

Limitations

- Can become cluttered on small intervals

- Still subject to noise

Data Intervals

Charts can be constructed using different time intervals. This is called the --data interval--.

Common intervals include:

- 1-minute

- 5-minute

- 10-minute

- Hourly

- Daily

- Weekly

- Monthly

Smaller intervals provide more detail but also more noise. Larger intervals smooth out volatility and emphasize structure.

For example:

A 10-minute chart in a 6.5-hour trading day produces 39 candles. A daily chart condenses that same activity into one candle.

Both describe the same day — but at different resolutions.

This concept reflects the fractal nature of markets. Patterns repeat across timeframes, but clarity varies.

Smaller Intervals

- More detail

- More volatility

- More false signals

Larger Intervals

- Smoother trends

- Less noise

- Clearer macro structure

Traders choose intervals based on time horizon.

Trend Context First

Use Introduction to Charts — Line, Bar & Candlestick Charts Explained with trend context instead of as a standalone trigger.

Charts are the language of technical analysis.

They convert price into structure. Structure reveals behavior. Behavior reflects psychology.

Understanding:

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

- Line charts

- Bar charts

- Candlestick charts

- Data intervals

provides the foundation for all advanced analysis.

Before using indicators, traders must understand what price itself is communicating.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

Charts do not forecast.

They organize.

And organized information leads to better decisions.

Quick FAQ

Which chart type is best for beginners?

Start with candlesticks because they show OHLC clearly and make momentum shifts easier to see. Use line charts for high-level trend context.

When should I use line charts instead of candles?

Use line charts when you want cleaner long-term direction and less noise. Use candles when entry timing and intraperiod behavior matter.

How do I choose the right interval?

Choose intervals based on holding period. Investors should anchor on daily or weekly charts; short-term traders can refine entries on lower intervals.

Can two intervals show opposite signals at the same time?

Yes. A lower timeframe can pull back while the higher timeframe trend remains intact. That is why top-down analysis is essential.

What is the most common chart-reading mistake?

Treating one candle or one small pattern as decisive without context. Structure, location, and timeframe alignment matter more than any single bar.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing Introduction to Charts — Line, Bar & Candlestick Charts Explained.

The Basic Principle of Technical Analysis — The TrendUnderstand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.Technical · 12 min read

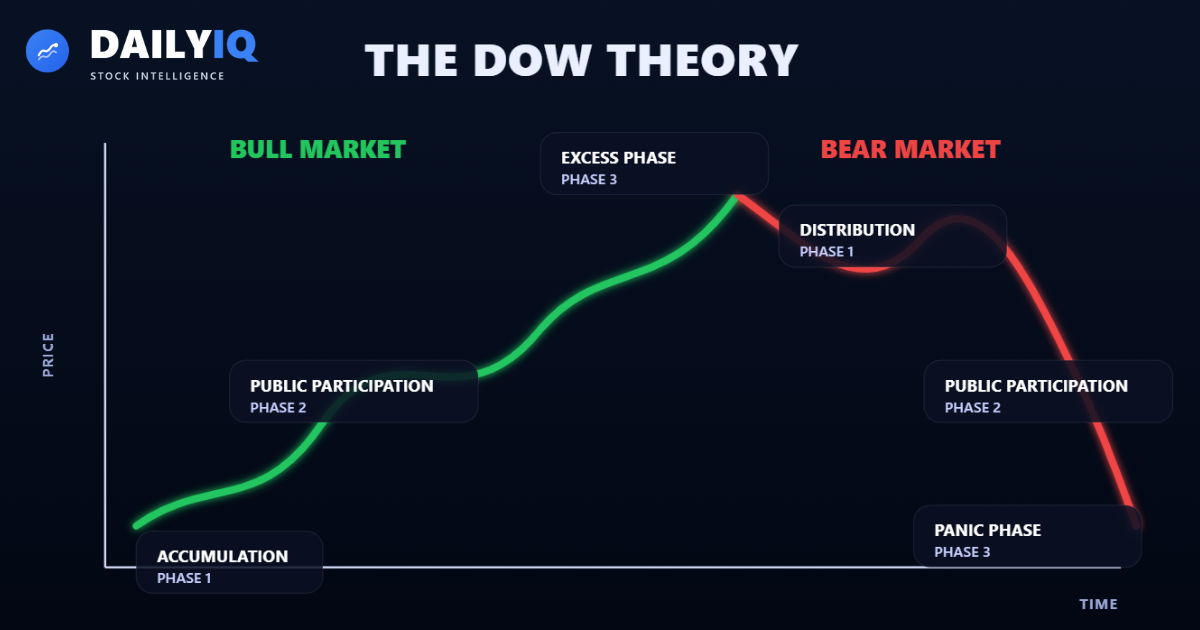

The Basic Principle of Technical Analysis — The TrendUnderstand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.Technical · 12 min read Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read

Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read