The Basic Principle of Technical Analysis — The Trend

Understand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.

Introduction To The Basic Principle of Technical Analysis — The Trend

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

Technical analysis rests on one central idea:

Market prices tend to move in trends.

The goal of the technical analyst is not to predict every fluctuation. Instead, the objective is to:

- Detect emerging trends early

- Participate while evidence supports continuation

- Exit when evidence shifts

- Protect capital throughout the process

This sounds simple in theory — buy early, ride the move, and sell before reversal.

In reality, it requires structure, discipline, and risk management.

Why Trends Matter

Trends are where profits are made.

If price moves randomly, opportunity disappears. But when price develops sustained directional movement, traders and investors can align themselves with that movement.

However:

- Trends rarely move in straight lines

- Counter-moves occur inside larger trends

- False signals happen

- Sudden reversals are possible

This is why trend participation must always include risk control.

Successful technical analysis depends on two critical decisions:

- When to enter

- When to exit (for profit and for loss)

Predefined exit levels prevent small mistakes from becoming large losses.

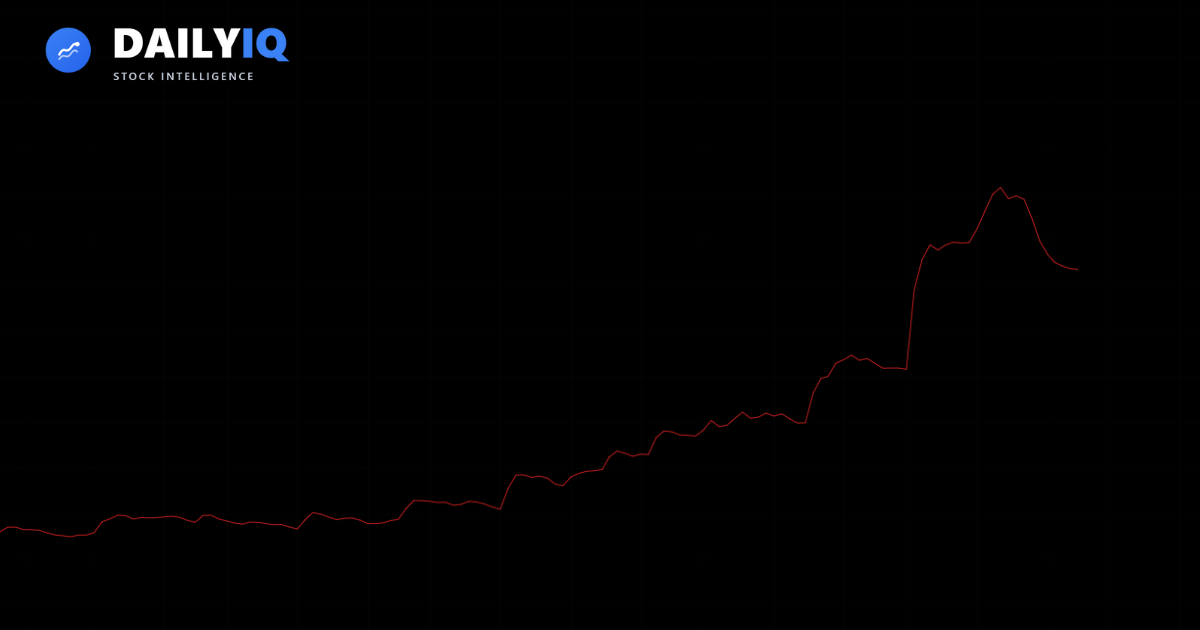

What Is a Trend?

A trend is a directional price movement that persists long enough to be identified and acted upon profitably.

There are three primary types:

Uptrend

An uptrend forms when price makes:

- Higher highs

- Higher lows

Each rally exceeds the previous rally.

Each pullback holds above the prior low.

Downtrend

A downtrend forms when price produces:

- Lower highs

- Lower lows

Each bounce fails below the previous peak.

Each decline pushes lower.

Sideways Trend

A sideways (range-bound) trend occurs when:

- Highs and lows remain relatively horizontal

- No sustained upward or downward direction develops

Although textbook diagrams appear clean, real markets are messy. Trends include noise, retracements, and emotional swings.

Trends Exist Across Timeframes

Trends are not confined to one timeframe.

They are commonly classified as:

- Primary Trend — Months to years

- Secondary Trend — Weeks to months

- Short-Term Trend — Days

- Intraday Trend — Minutes or hours

Shorter trends exist within longer ones.

A short-term decline can occur inside a strong long-term uptrend.

This multi-layered structure is often described as fractal behavior — similar patterns repeating across different scales.

Your relevant trend depends entirely on your time horizon.

How Trends Are Identified

No single method guarantees accuracy. Analysts combine structure and tools to form probabilistic conclusions.

1. Price Structure

The most fundamental method is observing highs and lows:

- Higher highs + higher lows = uptrend

- Lower highs + lower lows = downtrend

Structural breaks often signal potential reversals.

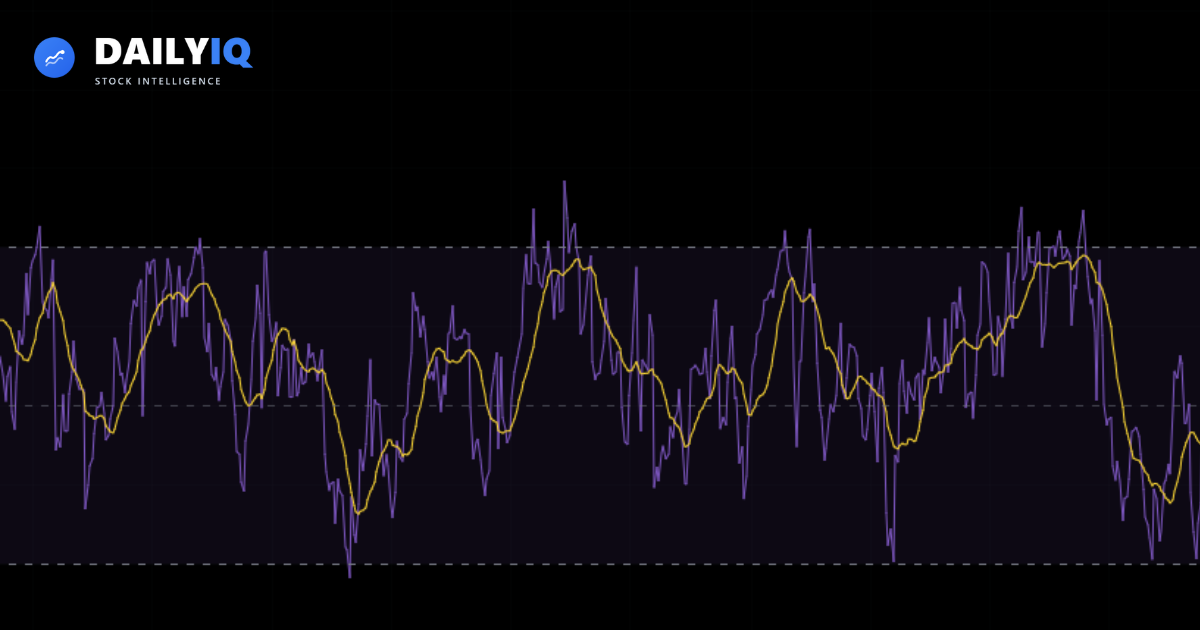

2. Moving Averages

Moving averages smooth short-term fluctuations.

They help:

- Reduce noise

- Clarify directional bias

- Identify momentum shifts

When price consistently holds above a rising average, an uptrend may be intact.

3. Trend Lines

Trend lines connect significant highs or lows.

They provide:

- A visual sense of slope

- Dynamic support or resistance

- Early warning signals if broken

A decisive break of a well-established trend line may signal changing momentum.

4. Statistical Methods

Linear regression can estimate average direction over time.

However, statistical confirmation often lags. By the time enough data confirms a trend, it may already be changing.

For this reason, many analysts prioritize structure over pure statistics.

Trends Develop from Supply and Demand

At its core, price reflects supply and demand.

Every transaction represents agreement between:

- A buyer willing to pay

- A seller willing to accept

When buyers become more aggressive, prices rise.

When sellers dominate, prices fall.

Technical analysis focuses on price because price represents the collective result of:

- Information

- Expectations

- Fear and optimism

- Liquidity needs

- Speculation

Rather than analyze every fundamental input, technical analysts study the output: price behavior.

Core Assumptions of Technical Analysis

Beyond the belief that markets trend, technical analysis rests on several foundational assumptions.

1. Price Is Driven by Supply and Demand

Investor psychology influences buying and selling decisions.

Fear, greed, and expectations shape price movement.

2. Price Discounts Everything

All known information — including interpretations and expectations — is assumed to be embedded in price.

Instead of analyzing every input, the analyst studies the result.

3. Prices Are Not Purely Random

While markets can appear chaotic, technical analysts believe structured behavior emerges because human reactions are not random.

4. History Tends to Echo Itself

Exact repetition is rare.

Behavioral repetition is common.

Similar conditions often produce similar market responses.

5. Patterns Are Fractal

Patterns appear across multiple timeframes.

A formation on a five-minute chart may resemble one on a monthly chart.

This reflects consistent behavioral tendencies across different horizons.

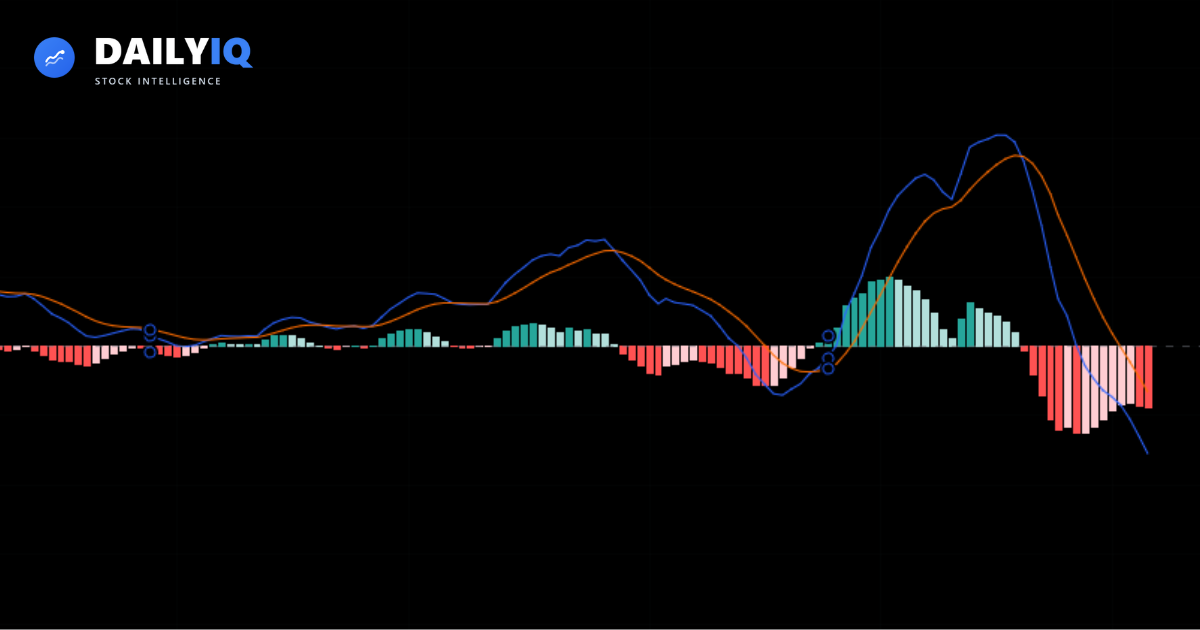

Emotional Feedback Loops

Markets are influenced by emotional reinforcement cycles.

- Rising prices create confidence → more buying → further rises

- Falling prices create fear → more selling → further declines

These feedback loops can produce:

- Bubbles

- Panic selloffs

- Overshooting beyond equilibrium

Eventually, extremes revert — often swinging too far in the opposite direction.

Understanding these emotional cycles helps explain why trends accelerate and eventually reverse.

Risk Management: The Hidden Foundation

Even perfect trend identification cannot eliminate uncertainty.

Technical success requires:

- Defined exit levels

- Acceptance of small losses

- Capital preservation

- Discipline over prediction

Without risk management, even correct analysis can fail.

The objective is not certainty.

It is structured probability.

Establish Trend Context First

Always begin by identifying the broader trend before evaluating individual signals. Technical analysis is not about isolated indicators, but about understanding the directional structure of price.

Markets move through recognizable phases driven by supply and demand, and trend context provides the framework that determines whether a signal has higher probability.

The core principle of technical analysis is simple: trade in alignment with the prevailing trend whenever possible.

Wait For Structural Confirmation

Confirmation helps distinguish meaningful moves from temporary noise. Before committing capital, validate signals using price structure, volume behavior, or momentum alignment.

Markets typically:

- Move in directional waves

- Contain temporary counter-moves

- Reflect shifts in supply and demand

- Exhibit recurring behavioral patterns

- Display fractal structure across multiple timeframes

A valid trend should be identifiable early, sustained long enough to trade, and supported by confirming evidence.

Maintain Consistent Risk Management

Risk management must remain consistent regardless of market conditions. Fixed risk rules prevent emotional decision-making and ensure long-term survivability.

Effective execution requires:

- Defined entry and exit criteria

- Pre-planned position sizing

- Strict adherence to stop-loss discipline

- Consistency across different market regimes

Technical analysis improves probability, but it does not eliminate uncertainty. Managing risk is what protects capital over time.

Quick FAQ

What is the fastest way to identify trend direction?

Start with structure first: higher highs and higher lows for uptrends, lower highs and lower lows for downtrends. Use moving averages only as confirmation, not as the primary definition.

How do I tell a pullback from a real reversal?

A pullback usually holds prior structure. A reversal usually breaks structure, fails to reclaim key levels, and is often supported by momentum and volume deterioration.

What if different timeframes disagree?

Prioritize the timeframe that matches your holding period. Treat lower-timeframe signals against the higher-timeframe trend as tactical, smaller-size trades.

Where should stops go in trend trading?

Place stops where your trend thesis is invalidated, usually beyond a recent swing level or a volatility-adjusted buffer. Avoid arbitrary fixed-dollar stops.

Can trend analysis work without indicators?

Yes. Price structure alone can define trend. Indicators can improve consistency, but they should support structure rather than replace it.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing The Basic Principle of Technical Analysis — The Trend.

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read

What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read

Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read

What Are Heikin Ashi Candles and How to Read ThemLearn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.Technical · 6 min read