Dow Theory History, Theorems, Trends, Confirmation, Volume & Criticisms

A comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.

Introduction To Dow Theory History, Theorems, Trends, Confirmation, Volume & Criticisms

Dow Theory is one of the earliest structured frameworks for understanding market behavior. Developed from the writings of Charles H. Dow in the late 19th and early 20th century, it forms the intellectual foundation of modern technical analysis. Although Dow himself never formally published a book outlining the theory, his editorials laid out principles that were later organized and expanded by William Peter Hamilton and Robert Rhea.

At its core, Dow Theory attempts to answer a fundamental question:

How do markets move?

Rather than focusing on individual stock stories, Dow believed market averages reflected collective economic expectations. His work suggested that price behavior reveals more about future economic conditions than backward-looking financial reports.

Dow Theory does not promise perfect timing. It does not claim to identify exact tops or bottoms. Instead, it provides a disciplined framework for interpreting market structure.

Dow Theory teaches that:

- Markets move in identifiable trends

- Trends unfold in phases

- Major averages must confirm each other

- Volume supports price direction

- Emotional cycles drive excess and correction

Understanding these principles provides a structural lens through which market behavior becomes more interpretable.

Dow Theory originated from observations about stock market averages and their relationship to economic activity. Charles Dow created both an industrial average and a transportation (originally railroad) average because he believed production and distribution must move together in a healthy economy. If factories are producing goods, those goods must be transported to customers. When one average rises without the other, something may be misaligned.

After Dow's passing, William Hamilton continued refining these ideas through decades of market commentary. Later, Robert Rhea organized these writings into a structured doctrine. Over time, Dow Theory became less about specific indices and more about a generalized framework for trend identification and confirmation.

Early academic research criticized Dow Theory for lagging in recognizing major reversals. However, later studies suggested that while signals may come after a turning point, they often reduce volatility and help avoid catastrophic declines. The theory was never meant to capture exact turning points -- it was designed to align investors with dominant market movements.

Key historical insights:

- Dow never formalized the theory into a book

- Later analysts structured his ideas into formal principles

- Market averages were designed as economic barometers

- The theory emphasizes discipline over precision

- It remains foundational despite technological evolution

The Core Theorems of Dow Theory

Dow Theory rests on several central propositions describing how markets behave over time. One major idea is that markets move in recognizable cycles. These cycles include advances, peaks, declines, and bottoms. While the "ideal market picture" is theoretical, it serves as a conceptual model for understanding long-term price movement.

Another foundational principle is that economic logic should support price trends. Dow believed that major economic sectors must move together. If industrial output expands, transportation activity should also expand. Divergence between key sectors may signal weakness.

Perhaps the most fundamental theorem is that prices trend. Markets do not move randomly in extended time horizons. Although short-term movement may appear chaotic, long-term structure emerges as investor expectations evolve.

These theorems collectively argue that:

- Market prices reflect broad economic conditions

- Long-term direction matters more than short-term noise

- Trends unfold in structured patterns

- Confirmation between sectors increases reliability

- Markets are driven by collective psychology

Dow Theory does not require perfect precision. It provides a framework for identifying dominant forces shaping price behavior.

The Three Types of Trends

Dow Theory identifies three simultaneous movements within price data: primary, secondary, and minor trends. These trends are layered and often overlap, which explains why markets can appear confusing at first glance.

The primary trend represents the dominant long-term movement and may last several years. It reflects broad economic expansion or contraction. The secondary trend is an intermediate counter-movement that temporarily moves against the primary direction. These reactions often retrace a meaningful portion of the previous move and can last weeks or months. The minor trend consists of daily fluctuations and short-term noise.

Understanding these layers prevents misinterpretation. Many investors mistake secondary corrections for primary reversals. Dow emphasized focusing primarily on identifying the direction of the longest trend.

Trend structure summary:

- Primary trend: multi-year bull or bear market

- Secondary trend: corrective reaction within primary trend

- Minor trend: daily movement and short-term volatility

- All three may operate simultaneously

- The primary trend deserves the greatest attention

The investor's challenge is distinguishing temporary pullbacks from structural reversals.

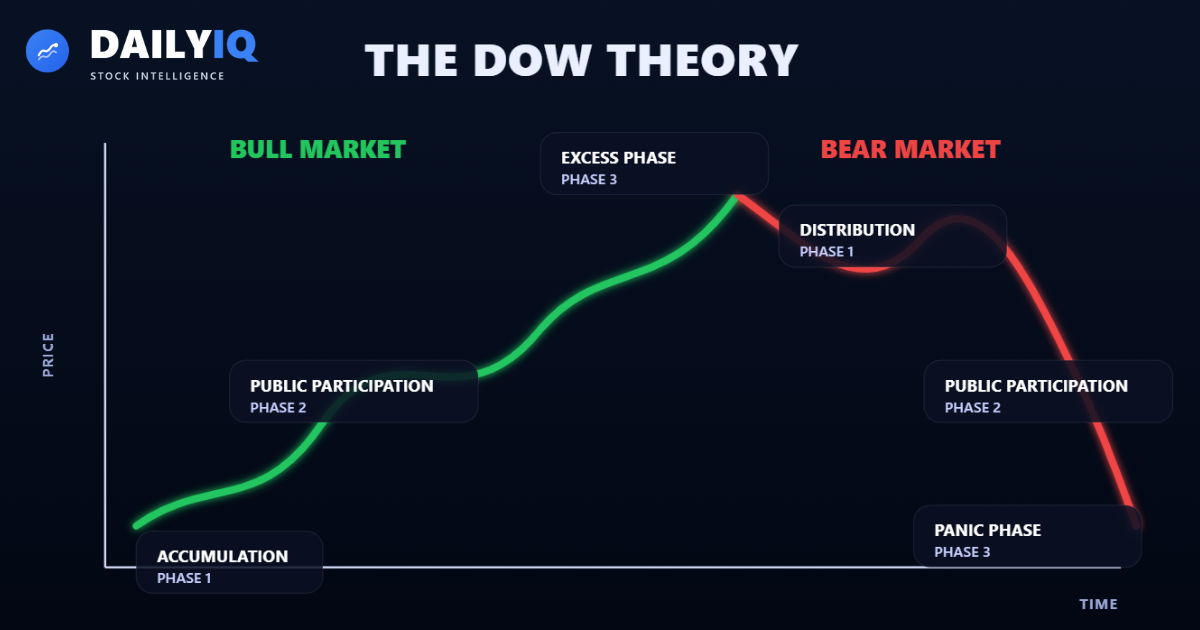

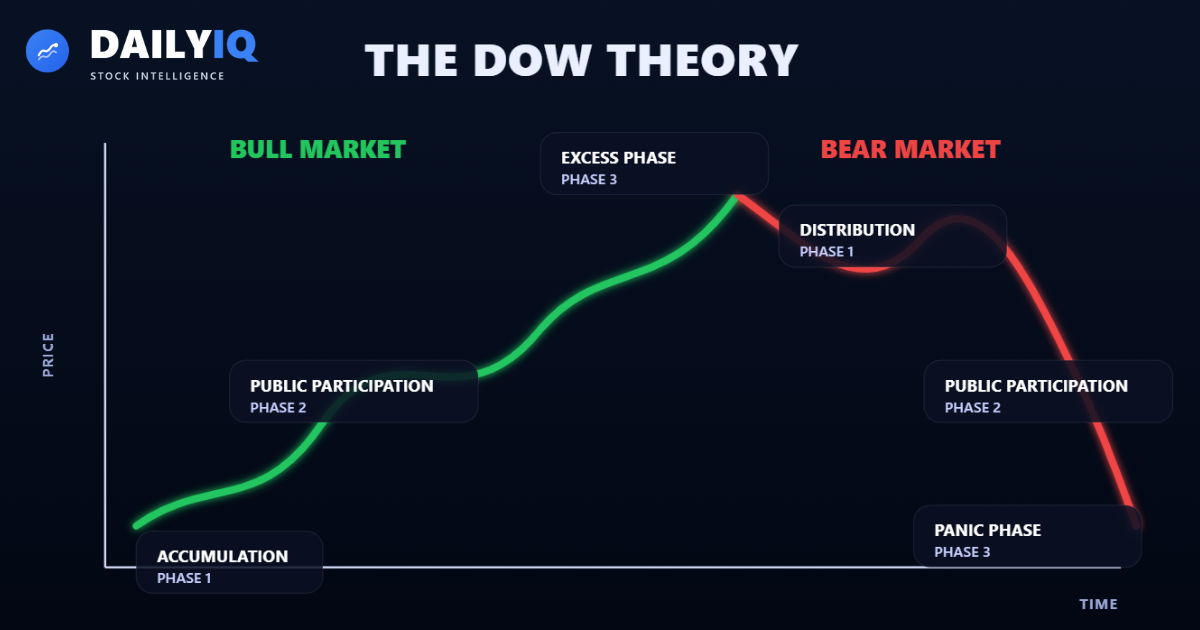

The Primary Trend and Its Phases

The primary trend is the backbone of Dow Theory. It represents the long-term direction of the market and is considered the most important determinant of investment success. Dow argued that correctly identifying this dominant movement outweighs short-term timing precision.

Primary bull markets typically unfold in three phases. The first phase begins quietly after a bear market when informed investors begin accumulating assets. The second phase sees improved corporate earnings and expanding economic activity, attracting broader participation. The final phase is marked by speculative enthusiasm, where prices rise largely on optimism and expectation.

Primary bear markets also unfold in three phases. The first phase reflects fading optimism. The second phase corresponds to deteriorating economic conditions and declining earnings. The third phase often involves panic-driven liquidation.

Primary trend characteristics:

- Reflects long-term economic cycles

- Cannot be forecasted precisely in duration

- Bull markets unfold through accumulation, expansion, speculation

- Bear markets unfold through distribution, contraction, panic

- Focus on direction rather than exact timing

The theory emphasizes alignment with the dominant movement rather than predicting its termination.

The Secondary and Minor Trends

Secondary trends are intermediate reactions that move against the primary direction. They typically retrace a substantial portion of the previous move and can create confusion. Because secondary corrections often resemble early stages of primary reversals, they are among the most difficult elements of Dow Theory to interpret.

Minor trends consist of daily price movement and short-term fluctuations. Dow cautioned against drawing conclusions from single-day moves. Short-term volatility often reflects noise rather than structural change. Excessive focus on minor trends can lead to overtrading and emotional decision-making.

Dow's cautionary lessons include:

- Secondary trends often retrace one-third to two-thirds of prior movement

- Intermediate corrections may last several weeks or months

- Minor daily movement is unreliable when viewed in isolation

- Short-term randomness increases as timeframe shrinks

- Long-term focus reduces emotional trading errors

Understanding these distinctions reduces the risk of misclassifying market movement.

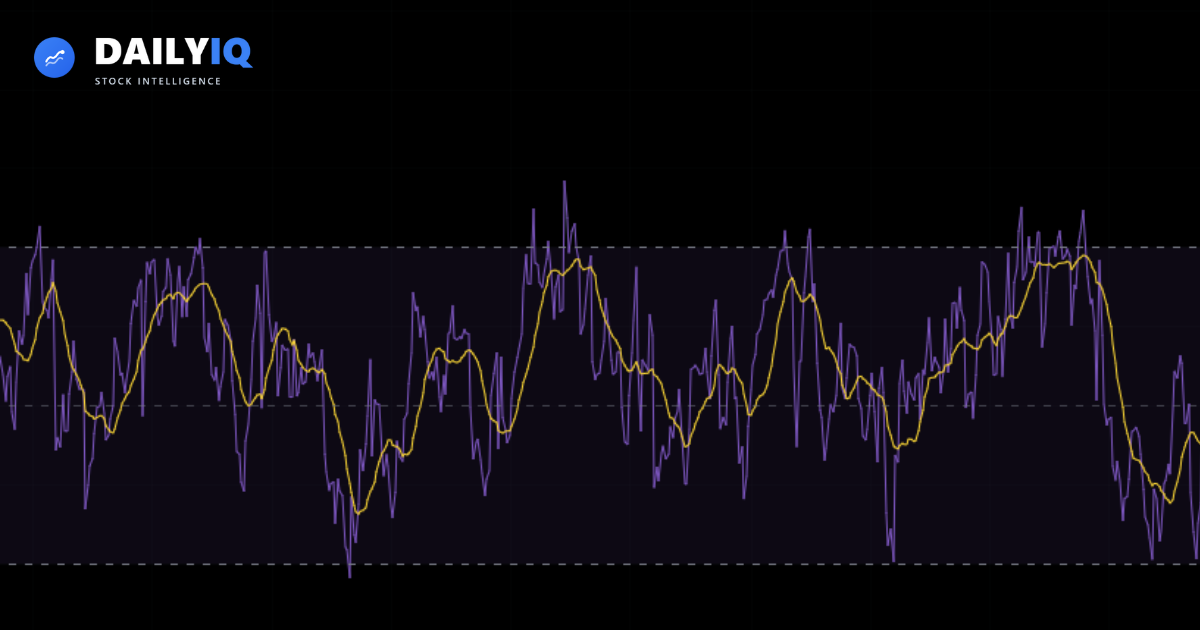

The Concept of Confirmation

Confirmation is central to Dow Theory. A trend is considered valid only when multiple market averages confirm each other. Historically, industrial and transportation averages were used. Today, broader indices such as the S&P 500 and Russell 2000 often serve this role.

If one index makes a new high while another fails to do so, the move lacks confirmation. Such divergence may signal weakening trend strength. Confirmation requires broad participation across sectors.

Confirmation principles:

- Major indices must move in the same direction

- New highs or lows should occur across averages

- Divergence warns of potential reversal

- Confirmation reduces false signals

- Multi-sector alignment strengthens trend validity

Confirmation acts as a safeguard against premature conclusions.

Importance of Volume

Dow Theory treats volume as secondary but supportive. Volume should expand in the direction of the primary trend. Rising prices accompanied by increasing activity indicate conviction. Declining prices with expanding volume signal strong selling pressure.

However, Dow did not treat volume as primary evidence. Price trend and confirmation override volume signals. Volume provides context rather than standalone signals.

Volume interpretation guidelines:

- Rising volume confirms strong trend movement

- Weak volume during rallies signals caution

- Heavy volume during declines indicates distribution

- Volume is relative to market activity

- Price structure outweighs volume alone

Volume reinforces the strength behind price movement but does not independently define trend direction.

Criticisms of Dow Theory

Despite its foundational role, Dow Theory has faced criticism. One common critique is that it lags in recognizing major reversals. Because confirmation requires observable movement, signals occur after initial turning points. Critics argue this may result in entering after bottoms or exiting after tops.

Another criticism concerns trend classification. Distinguishing between secondary reactions and primary reversals is not always clear. Market interpretation involves judgment rather than strict formulas.

Others argue that Dow Theory's reliance on closing prices and index confirmation may overlook nuanced intraday shifts.

Major criticisms include:

- Signals occur after trend changes begin

- Trend classifications can be ambiguous

- Requires judgment rather than strict formulas

- May produce delayed entries and exits

- Focuses on confirmation rather than prediction

However, proponents argue that the theory prioritizes risk reduction over precision. It seeks to minimize catastrophic errors rather than capture exact turning points.

Modern Relevance of Dow Theory

Although markets have evolved dramatically since Dow's era, the psychological and structural principles remain relevant. While industrial and railroad averages once dominated, modern analysts adapt confirmation principles to broader equity indices.

Today's markets operate with algorithmic trading, global liquidity, and instantaneous data. Yet long-term trends still emerge from collective investor behavior. Emotional cycles continue to drive excess optimism and fear.

Modern adaptations include:

- Using large-cap and small-cap indices for confirmation

- Applying confirmation principles across sectors

- Integrating volume and momentum indicators

- Multi-timeframe analysis

- Risk management overlay

Dow Theory provides a structural base upon which modern technical systems are built.

Trend Context First

Dow Theory is a structural framework, not a short-term timing tool. Focus on dominant trends first and interpret market behavior through long-horizon structure instead of isolated signals.

Wait For Confirmation

Require alignment from structure, cross-market confirmation, volume, and momentum before committing capital, and avoid overreacting to short-term noise or single-session moves.

Risk Rules Stay Fixed

Keep risk rules and invalidation levels fixed so execution stays consistent through emotional cycles of optimism and fear; the goal is disciplined decisions, not perfect prediction.

Quick FAQ

What does confirmation mean in Dow Theory today?

It means broad participation. If one major index breaks out but others lag, the signal is weaker. Strong trends usually show alignment across related benchmarks.

Is Dow Theory too lagging to be useful?

It is intentionally conservative. You may enter later than the exact bottom, but you reduce the chance of acting on false turns and major whipsaws.

Which indices can replace industrial and transportation averages?

Common modern proxies are large-cap plus small-cap indices, or broad market plus cyclical sector confirmation. The principle is cross-market alignment, not one fixed pair.

How important is volume in Dow Theory decisions?

Volume is supportive evidence, not the primary trigger. Price trend and confirmation come first, and volume helps judge conviction behind the move.

When is a Dow Theory signal invalidated?

When confirmed structure breaks and follow-through fails across confirming indices. Treat failed confirmation as a warning to reduce risk or reassess bias.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing Dow Theory History, Theorems, Trends, Confirmation, Volume & Criticisms.

The Basic Principle of Technical Analysis — The TrendUnderstand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.Technical · 12 min read

The Basic Principle of Technical Analysis — The TrendUnderstand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.Technical · 12 min read What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read

What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read