What Are Heikin Ashi Candles and How to Read Them

Learn how Heikin Ashi candles smooth price action to help you identify trend strength, momentum shifts, and cleaner entries.

Introduction To What Are Heikin Ashi Candles and How to Read Them

Use this guide as a practical framework. Pair each signal with trend structure, volatility context, and predefined risk controls before acting.

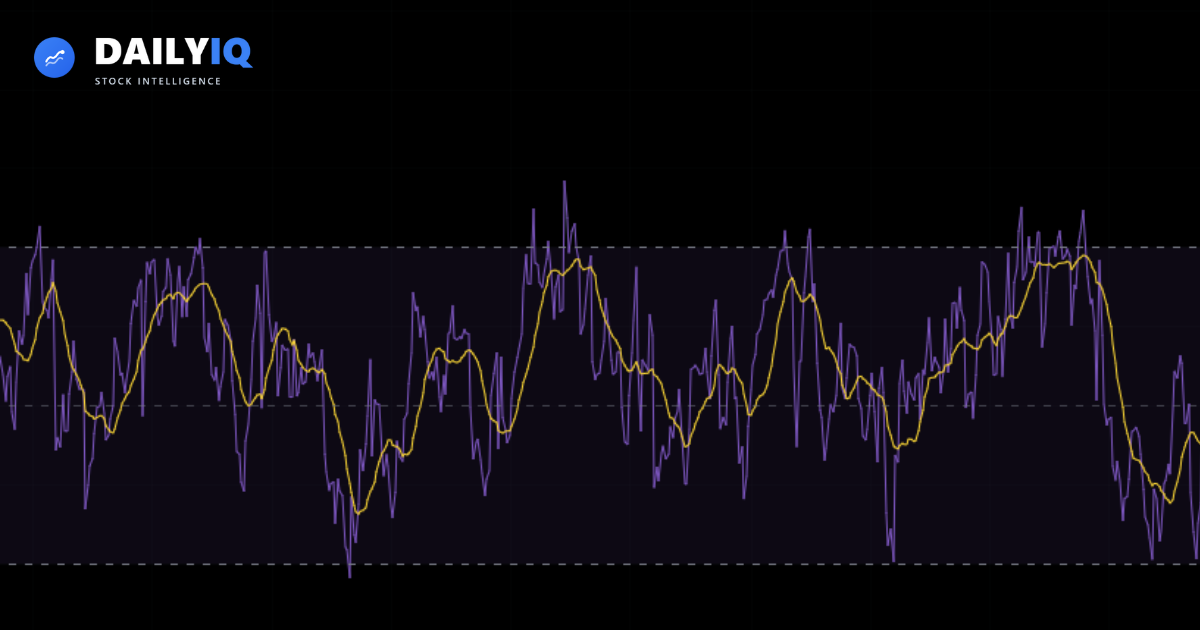

Heikin Ashi candles are a modified type of candlestick chart designed to smooth price action and make trends easier to see.

Unlike traditional candlesticks, which display raw open, high, low, and close prices for each period, Heikin Ashi candles use averaged values. This reduces noise and filters out minor fluctuations.

The result is a chart that highlights trend direction more clearly.

Heikin Ashi helps answer a key question:

Is the market trending cleanly, or is momentum starting to weaken?

It does not replace normal candlesticks. Instead, it simplifies price structure so traders can stay aligned with the dominant move.

How Heikin Ashi works

Heikin Ashi candles are calculated differently from regular candles.

Instead of using the exact open and close of the current period, they use averaged values.

The formulas are:

- HA Close = (Open + High + Low + Close) / 4

- HA Open = (Previous HA Open + Previous HA Close) / 2

- HA High = Maximum of (High, HA Open, HA Close)

- HA Low = Minimum of (Low, HA Open, HA Close)

Because each candle depends on the previous one, Heikin Ashi creates a smoother sequence.

This smoothing effect:

- Reduces small counter-trend candles

- Highlights strong directional moves

- Makes momentum shifts easier to identify

Reading Heikin Ashi candles

Heikin Ashi is primarily used to identify trend strength and potential reversals.

Strong bullish trend

In a strong uptrend:

- Candles are mostly green (or white).

- Bodies are large.

- There are little to no lower wicks.

When you see consecutive bullish candles with small or no lower shadows, it suggests strong upward momentum.

Strong bearish trend

In a strong downtrend:

- Candles are mostly red.

- Bodies are large.

- There are little to no upper wicks.

Consecutive bearish candles without upper shadows indicate strong selling pressure.

Trend weakening signals

Heikin Ashi makes transitions easier to spot.

Signs of potential weakening:

- Smaller candle bodies

- Appearance of both upper and lower wicks

- Color change after a strong trend

When candle bodies shrink and shadows appear on both sides, it may signal consolidation or a coming reversal.

However, one candle alone is not confirmation. Context still matters.

Heikin Ashi vs traditional candlesticks

Traditional candlesticks:

- Show exact price action.

- Provide precise entry and exit levels.

- Reveal gaps and intraday volatility.

Heikin Ashi candles:

- Smooth price action.

- Reduce noise.

- Highlight trends more clearly.

- Do not reflect exact price values.

Because Heikin Ashi uses averages, the open and close shown are not the actual market prices.

For this reason:

- Many traders analyze trend with Heikin Ashi.

- But execute trades using normal candlesticks.

Heikin Ashi in trending vs ranging markets

Heikin Ashi performs best in trending markets.

In strong trends:

- Candles stay one color for extended periods.

- Pullbacks appear smoother.

- Trend continuation becomes clearer.

In range-bound markets:

- Candle colors switch frequently.

- Signals become less reliable.

- Noise reduction helps, but trend clarity decreases.

Understanding overall market structure improves Heikin Ashi interpretation.

Using Heikin Ashi for entries and exits

Traders often use simple rules with Heikin Ashi.

Trend-following approach:

- Enter when a strong candle forms in trend direction.

- Stay in trade while candles remain strong and consistent.

- Exit when opposite color candles appear with strong wicks.

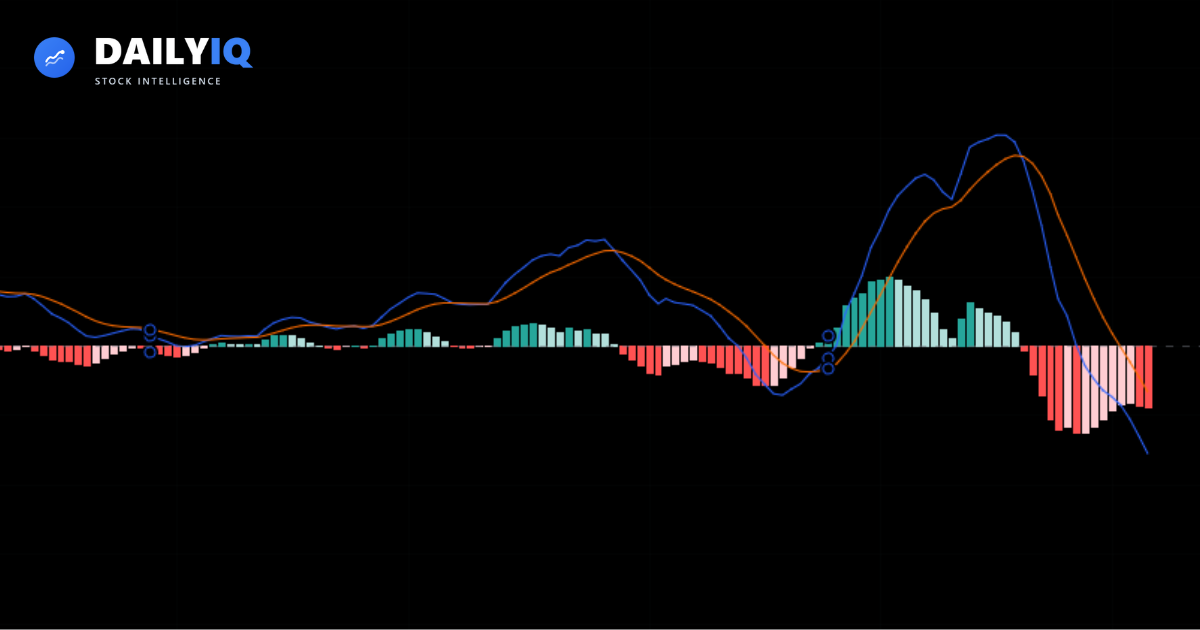

Some traders combine Heikin Ashi with:

- EMA for trend direction

- RSI for momentum confirmation

- Support and resistance levels

- Volume analysis

Heikin Ashi works best as a trend filter rather than a standalone signal generator.

Heikin Ashi and momentum shifts

One of the most valuable features of Heikin Ashi is how clearly it shows transitions.

Common transition pattern:

- Strong candles with no opposite wicks

- Smaller candle with both wicks

- Color shift

This sequence often signals slowing momentum before a potential reversal.

However, in strong trends, temporary color changes can be false signals. Always confirm with broader structure.

How DailyIQ uses Heikin Ashi

DailyIQ incorporates Heikin Ashi as part of its broader Technical Score framework.

Rather than using color changes alone as signals, DailyIQ evaluates Heikin Ashi alongside:

- EMA trend alignment

- RSI momentum conditions

- Volatility structure

- Volume confirmation

- Multi-timeframe agreement

For example:

- Strong Heikin Ashi candles aligned with rising EMA strengthen bullish bias.

- Heikin Ashi color shift with weakening RSI increases caution.

- Mixed signals reduce conviction.

Heikin Ashi becomes most powerful when used within a structured system.

Best practices

- Use Heikin Ashi to identify trend strength.

- Avoid using it for precise entry price levels.

- Confirm reversals with structure and momentum.

- Combine with EMA or other trend tools.

- Adjust expectations based on trending vs ranging conditions.

- Always manage risk.

Heikin Ashi simplifies trends — it does not eliminate uncertainty.

Trend Context First

Use What Are Heikin Ashi Candles and How to Read Them with trend context instead of as a standalone trigger.

Heikin Ashi candles provide a cleaner way to view price action by smoothing out market noise. By averaging price data, they make trends easier to recognize and momentum shifts more visible.

They are especially useful in strong trending markets, where consecutive candles clearly show direction and strength.

Wait For Confirmation

Wait for confirmation from structure, volume, or momentum before committing capital.

While they do not reflect exact market prices, their ability to highlight structure makes them a powerful trend-following tool.

Risk Rules Stay Fixed

Keep risk rules fixed so execution stays consistent across different market regimes.

When combined with other indicators and proper risk management, Heikin Ashi can improve clarity, reduce emotional decisions, and help traders stay aligned with momentum.

Quick FAQ

Can I execute trades using Heikin Ashi prices?

You can, but execution is usually better on standard candlesticks because Heikin Ashi values are averaged and may not match tradable market prices exactly.

Is one color change enough to call a reversal?

No. Treat it as an early alert. Reversal quality improves when structure breaks, momentum weakens, and follow-through confirms.

What is the best use of Heikin Ashi?

Trend filtering. It helps you stay with directional moves longer by reducing visual noise from minor countertrend candles.

When does Heikin Ashi perform poorly?

In choppy, range-bound markets where candle colors alternate frequently and follow-through is limited.

Which indicators pair well with Heikin Ashi?

EMA for directional bias, RSI or MACD for momentum, and key support/resistance for trade location and invalidation.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing What Are Heikin Ashi Candles and How to Read Them.

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read

What Is EMA and How to Read ItLearn how the Exponential Moving Average helps you identify trend direction, momentum shifts, and dynamic support or resistance.Technical · 6 min read What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read

Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read