Advanced Chart Analysis: Scaling, Volume, and Comparative Charting Explained

A comprehensive guide to advanced chart construction including arithmetic vs logarithmic scales, dual y-axes, multi-line comparisons, and volume-based charting techniques.

Introduction To Advanced Chart Construction: Scaling, Volume & Comparative Charting

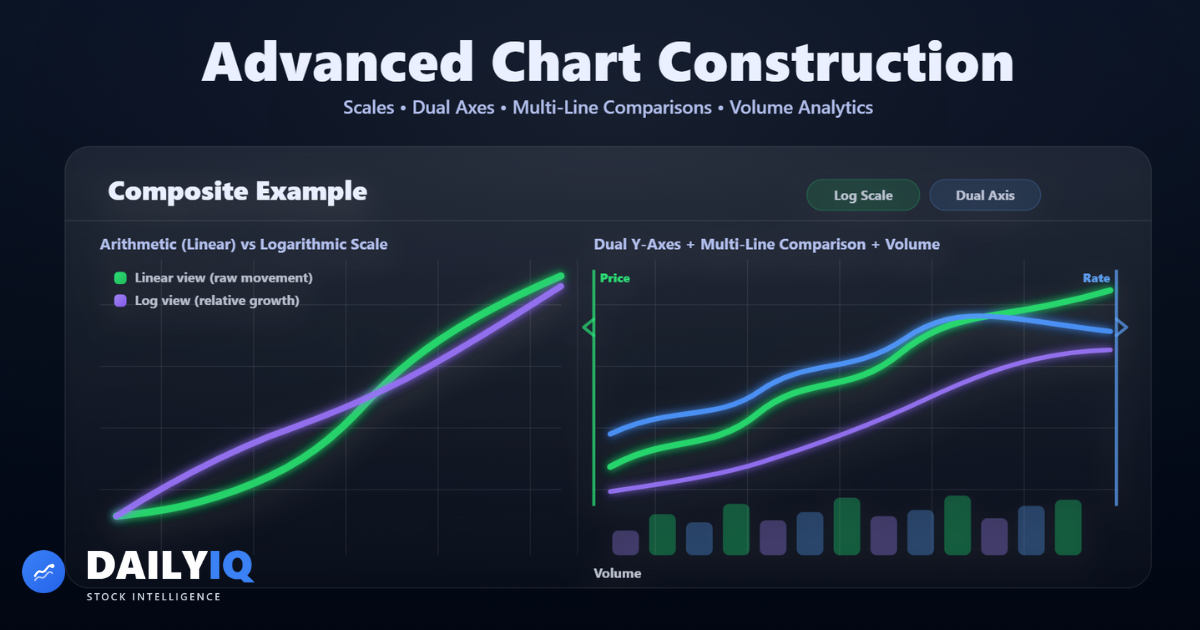

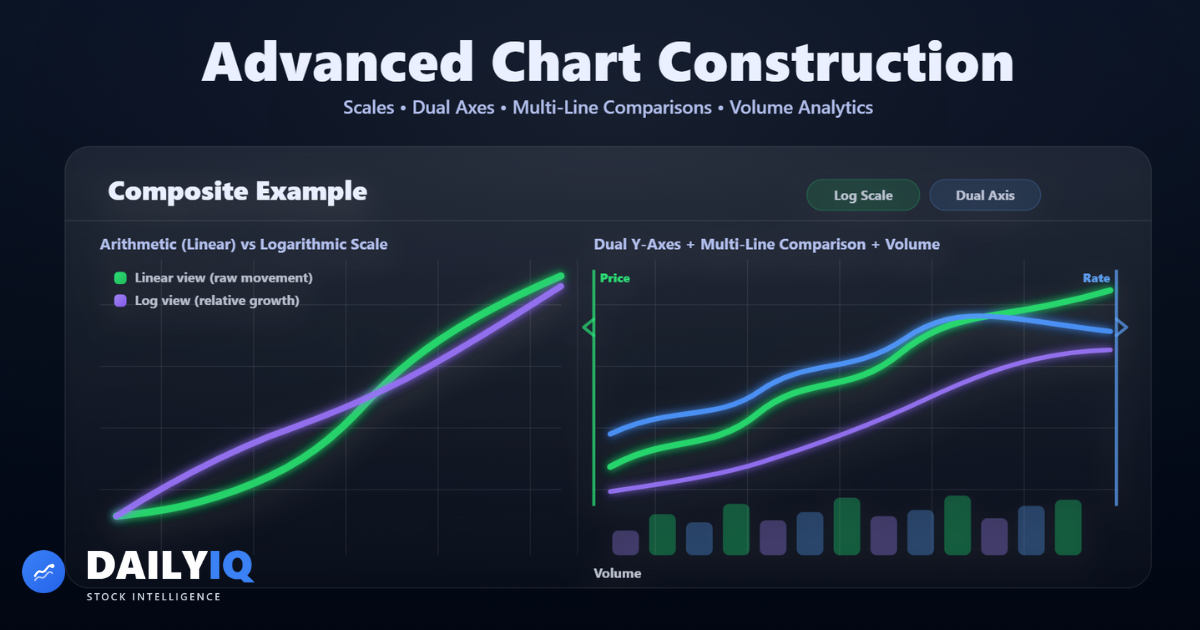

Advanced chart construction goes beyond simple candlesticks or line charts. The way price data is displayed fundamentally shapes how traders interpret trends, risk, and market structure. Two identical price series can appear dramatically different depending on whether a linear or logarithmic scale is used. A breakout may look convincing until volume reveals weak participation. Two indices may seem aligned until scaling exposes divergence.

This guide explores the structural elements that influence interpretation:

- Multi-line comparison charts

- Dual y-axis scaling

- Arithmetic vs logarithmic vertical scales

- Volume integration methods

- Equivolume visualization

- Volume-based interval charts

The goal is not cosmetic adjustment. It is analytical clarity.

Professional analysis requires understanding how chart construction affects perception. Scaling, axes, and volume integration are not minor formatting choices — they are interpretive filters that influence decisions.

Charts are tools. The structure you choose determines the story they tell.

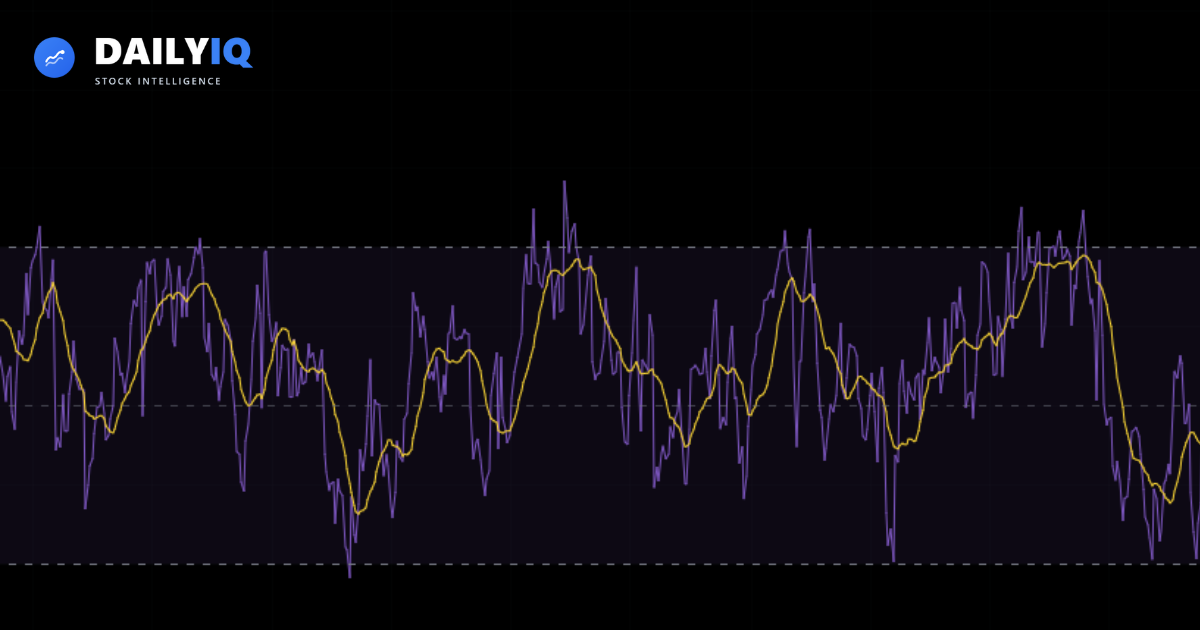

Multi-Line Charts: Comparing Multiple Time Series

Multi-line charts allow analysts to compare several securities or economic variables across the same time axis. Instead of focusing on one asset in isolation, this method highlights relationships, divergence, correlation, and leadership rotation.

For example:

- Comparing S&P 500, Nasdaq, and Dow Jones reveals internal market strength.

- Comparing gold and the US Dollar Index highlights macro relationships.

- Overlaying sector ETFs identifies capital rotation between industries.

The objective is structural comparison — not absolute price comparison. When viewing multiple lines, the analyst evaluates whether assets trend together, whether divergence is forming, or whether one asset leads another.

However, scaling is critical. If price magnitudes differ dramatically, interpretation can be distorted. In such cases, normalization or logarithmic scaling may be necessary.

Best practices:

- Focus on directional alignment

- Avoid cluttering with too many overlays

- Normalize when comparing different magnitudes

- Use log scale for long-term relative performance

Multi-line charts shift analysis from isolated price movement to relational structure.

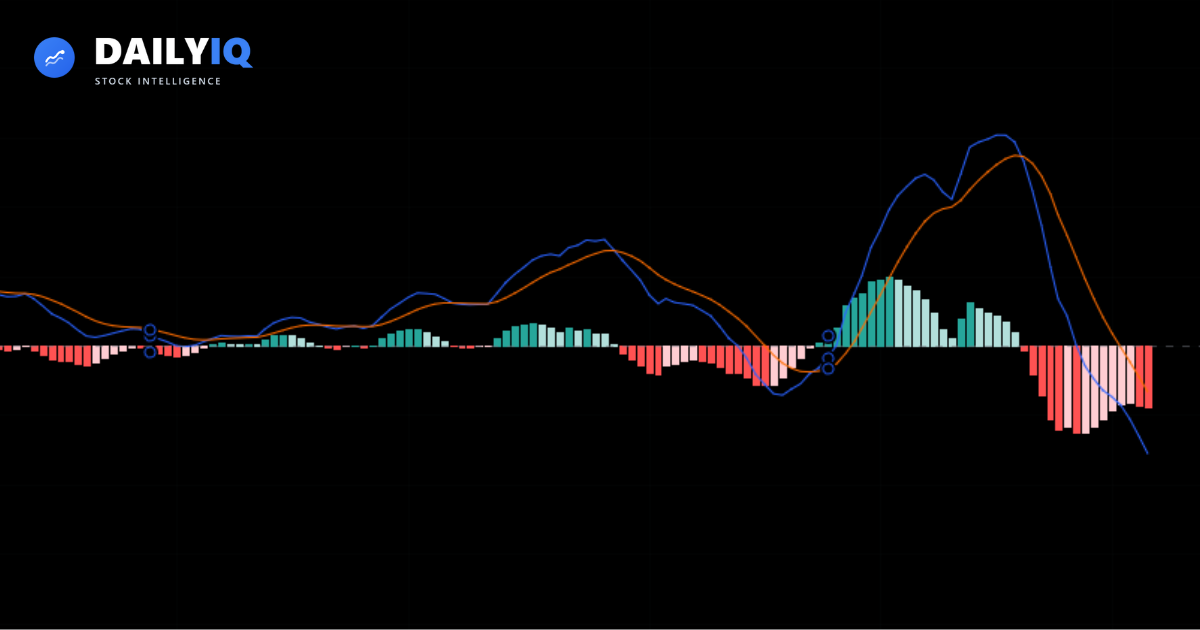

Dual Y-Axis Charts: Managing Magnitude Differences

When two variables trade at very different levels, plotting them on a single y-axis compresses one series into near invisibility. A dual-axis chart solves this by assigning one variable to the left vertical axis and the other to the right.

Common use cases include:

- Equity index vs bond yield

- Stock price vs macroeconomic data

- Commodity price vs currency index

This preserves visual clarity for both series. However, dual axes must be used responsibly. Manipulating scale ranges can artificially imply correlation. Overlapping lines do not guarantee statistical relationship.

Advantages:

- Preserves readability

- Allows cross-asset comparison

- Maintains proportional emphasis

Risks:

- Can exaggerate relationships

- May visually imply correlation

- Requires clear labeling

Dual-axis charts are powerful analytical tools when scaling integrity is maintained.

Arithmetic vs Logarithmic Scale

Choosing between arithmetic and logarithmic scaling is one of the most important decisions in chart construction.

An arithmetic (linear) scale spaces price levels evenly. A $10 move appears identical whether price is $20 or $200. This works well for short-term analysis where absolute price movement matters.

A logarithmic scale spaces values by percentage change. Equal vertical distance represents equal percentage movement.

Example:

- $10 → $20 (100% gain)

- $50 → $100 (100% gain)

On a log scale, both appear identical in height. On a linear scale, they do not.

When to use arithmetic scale:

- Short-term trading

- Range-bound markets

- Stable price environments

When to use log scale:

- Multi-year charts

- Exponential growth stocks

- Large percentage movements

- Long-term structural analysis

For long-horizon analysis, log scale more accurately reflects investor return and compounding growth.

Always verify which scale is active before drawing conclusions.

Volume Integration and Confirmation

Volume represents participation. Price shows direction — volume shows conviction.

Volume is typically displayed beneath price as vertical bars. Rising price with rising volume suggests strong participation. Rising price with declining volume may signal weakening momentum.

Common interpretations:

- Rising price + rising volume → trend strength

- Rising price + falling volume → potential fragility

- High volume at resistance → possible distribution

- Volume spike at breakout → confirmation

Volume does not independently define trend direction. It confirms or questions existing structure.

Guidelines:

- Compare current volume to historical averages

- Identify abnormal spikes

- Watch for divergence between price and volume

- Use volume as supporting evidence

Without volume, price lacks participation context.

Equivolume Charts

Equivolume charts combine price and volume into a single graphical structure. Instead of fixed-width candles, each bar’s width reflects trading volume while height reflects price range.

High-volume sessions appear wide. Low-volume sessions appear narrow.

This format emphasizes participation intensity without requiring a separate volume pane.

Advantages:

- Instantly highlights heavy trading days

- Integrates price and volume visually

- Useful during accumulation or distribution

Limitations:

- Distorts time spacing

- Less intuitive for beginners

- Harder to compare equal time intervals

Equivolume charts are best used as supplementary tools rather than primary analysis formats.

Volume-Based Interval Charts

Traditional charts use fixed time intervals. Volume-based charts replace time with activity. Each candle represents a fixed amount of traded volume rather than a fixed duration.

When trading activity is high, candles form rapidly. When activity is low, fewer candles appear.

Advantages:

- Emphasizes institutional participation

- Highlights momentum bursts

- Reduces low-activity noise

- Useful for intraday traders

Volume-based charts reveal patterns that time-based charts may obscure during high-volatility sessions.

They reinforce an important principle: participation often matters more than clock time.

Scaling Changes Perception

Verify whether a chart uses arithmetic or logarithmic scaling. Long-term structural analysis generally benefits from percentage-based log interpretation.

Compare Structure, Not Price

Multi-line charts reveal divergence and leadership rotation. Focus on directional alignment rather than raw price magnitude.

Volume Confirms Conviction

Strong trends require strong participation. Weak volume often signals fragile movement.

Advanced Chart FAQ

When should I use logarithmic scaling?

Use log scale for multi-year charts, exponential growth stocks, or when percentage change matters more than absolute price change.

Are dual-axis charts reliable?

They are useful but must be used carefully. Improper scaling can visually imply correlation that does not statistically exist.

Is volume required for all analysis?

Volume is not mandatory but significantly improves confidence assessment and breakout validation.

Are volume-based charts better than time-based charts?

Not universally. They are particularly useful in active trading environments but less essential for long-term structural analysis.

What is the biggest mistake traders make with chart scaling?

Forgetting to check whether the chart is linear or logarithmic, leading to distorted perception of long-term trend strength.

Learn About Investing

These resources can help investors evaluate momentum, volatility, and trend strength when analyzing Advanced Chart Analysis: Scaling, Volume, and Comparative Charting Explained.

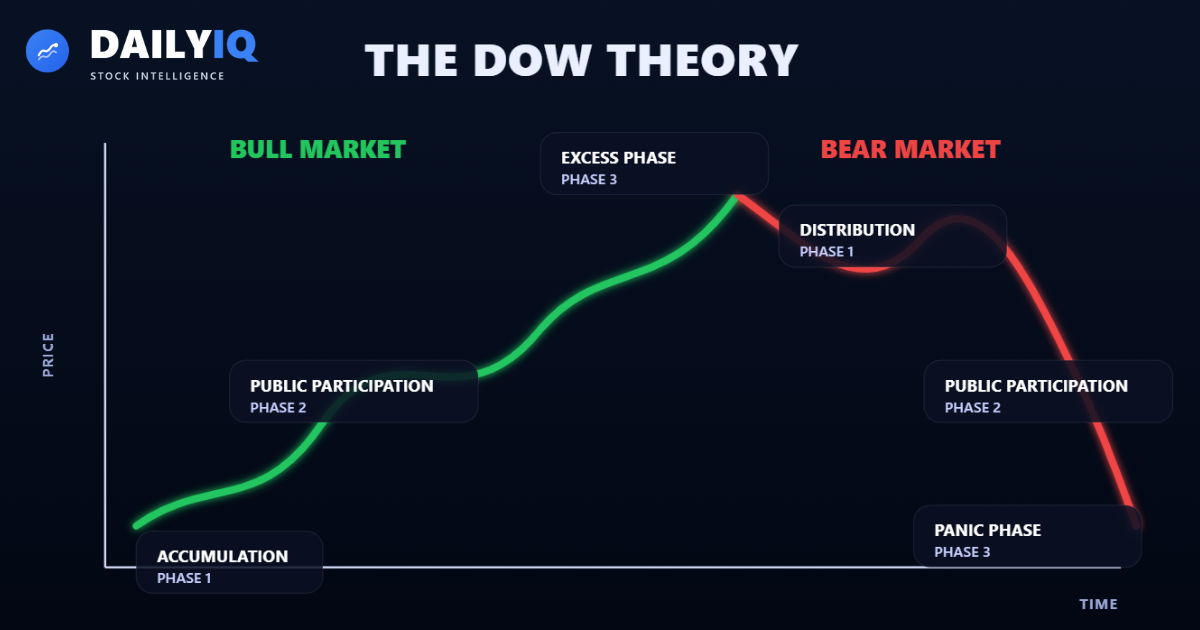

The Basic Principle of Technical Analysis — The TrendUnderstand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.Technical · 12 min read

The Basic Principle of Technical Analysis — The TrendUnderstand how trends form, why they matter, how they are identified, and the core assumptions technical analysts rely on when studying market price behavior.Technical · 12 min read Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read

Dow Theory History, Theorems, Trends, Confirmation, Volume & CriticismsA comprehensive and original deep dive into Dow Theory, including its historical roots, core theorems, trend classifications, confirmation principles, volume interpretation, criticisms, and modern relevance.Technical · 24 min read What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read

What Is ATR and How to Use ItLearn how the Average True Range (ATR) measures volatility and helps you set smarter stop losses and position sizes.Volatility · 6 min read What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read

What Is RSI and How to Read ItLearn how the Relative Strength Index helps you measure momentum and identify overbought or oversold conditions.Technical · 5 min read Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read

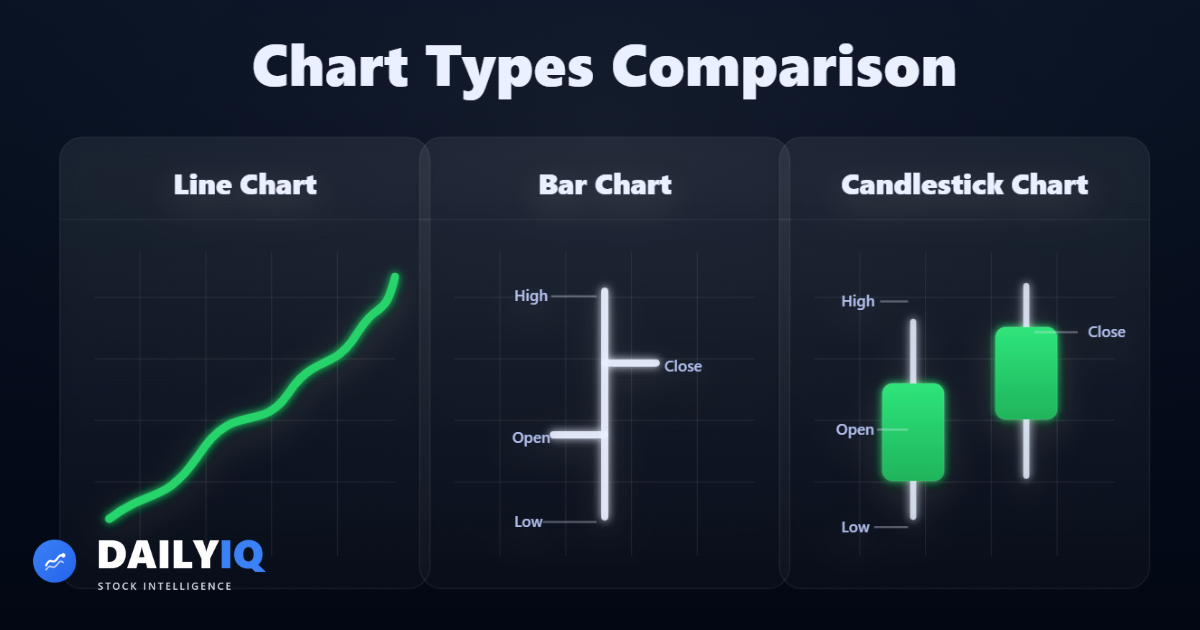

Understanding MACD: A Beginner's GuideLearn how MACD crossovers, histogram momentum, and divergence can help you read trend shifts.Technical · 6 min read Introduction to Charts — Line, Bar & Candlestick Charts ExplainedA complete beginner-to-intermediate guide to understanding how charts summarize price action, including line charts, bar charts, candlesticks, and data intervals.Technical · 22 min read

Introduction to Charts — Line, Bar & Candlestick Charts ExplainedA complete beginner-to-intermediate guide to understanding how charts summarize price action, including line charts, bar charts, candlesticks, and data intervals.Technical · 22 min read